Shifting investment preferences are reshaping fund audit fee landscapes

The investment fund industry is experiencing a seismic shift that's fundamentally altering both the competitive landscape and the economics of fund auditing. Our latest analysis of fund audit fee trends from 2020 to 2024 reveals a story of dramatic transformation, one where ETFs surge while traditional mutual funds contract, and where audit complexity translates directly into rising costs.

Over the past five years, the fund industry has witnessed a remarkable redistribution of assets and audit attention across fund types. While the overall number of fund registrants declined modestly by 3% (from 2,045 to 1,989), total audit fees climbed 5% to reach $515 million in 2024. This increase, primarily covering wage inflation, points to the pressures on this mature industry. There is a bright spot for the industry however, in exchange traded funds (ETFs).

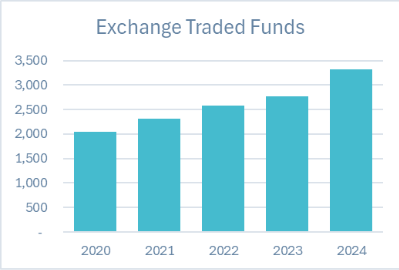

ETFs: The rocket ship of fund growth

According to ETFGI, the ETF industry enjoyed exceptionally strong growth in 2024, with global ETF assets reaching $14.85 trillion by year-end, up from $11.63 trillion at the end of 2023, driven by record-breaking net inflows. Our audit fee data illustrates the dramatic changes in the traditional open-ended and exchange traded funds.

Between 2020 and 2024, the number of ETFs surged an impressive 63%, from 2,043 funds to 3,322. This explosive growth created a parallel boom in ETF audit fees, which more than doubled during this period, jumping 106% from $40.6 million to $83.5 million. The average audit fee per ETF also increased, climbing from $19,867 to $25,125, a 26.5% increase that reflects the growing complexity of these instruments.

.png)

This shift toward active management within the ETF wrapper has significant implications for audit complexity and costs, as actively managed strategies require more intensive scrutiny than straightforward index-tracking funds.

PwC continues to dominate ETF auditing, accounting for over half of all ETF audit fees in 2024 ($43.9 million). However, Cohen & Company has emerged as a formidable competitor in this space, growing their ETF audit book from 212 funds in 2020 to 786 in 2024, a nearly four-fold increase that reflects their strategic focus on the high-growth ETF segment.

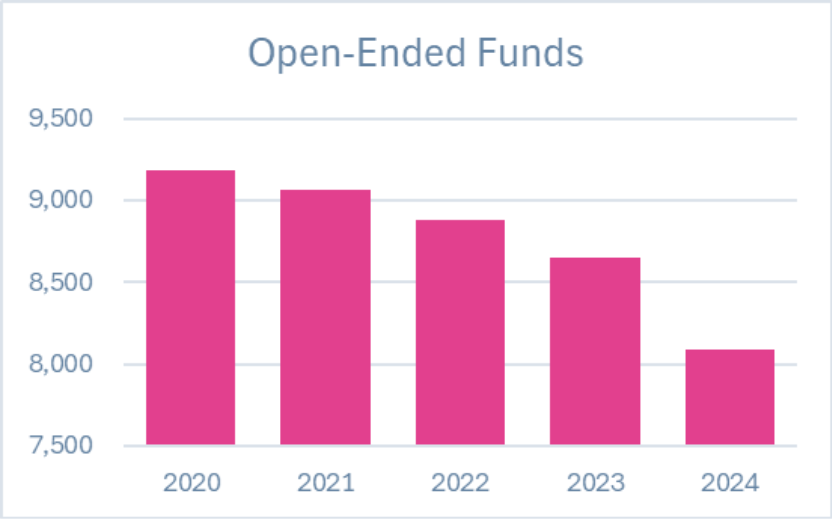

Traditional mutual funds: The long goodbye

While ETFs soared, open-ended mutual funds experienced the opposite trajectory. The number of these traditional funds declined 12% from 9,187 in 2020 to 8,087 in 2024, a contraction that reflects deeper industry trends.

According to PwC's "Mutual Funds 2030" outlook, the industry expects a 25% decline in mutual funds between now and 2030, partially offset by other investment products, including ETFs, which are expected to increase by 35% during the same period. PwC also predicts that up to 20% of mutual fund firms will be acquired or eliminated by 2030. Long-term outflows from mutual funds have been persistent, demonstrating sustained investor preference for other structures.

The audit fee story for open-ended funds shows stability but stagnation. Total audit fees for these funds declined modestly by 3% over the five-year period to $354 million in 2024, while average fees per fund increased 8% to $43,813, suggesting that the overall category is mature and in slow decline.

This decline reflects the structural consolidation in money market funds continues unabated, even as these funds remain an essential cash management tool for investors.

The Big Four's evolving strategies

The audit firm landscape reflects these changing fund dynamics:

PricewaterhouseCoopers maintains its dominant position across all fund types, but its strategy varies by category. In ETFs, PwC audited 1,367 funds in 2024 (41% of all ETFs) and captured $43.9 million in fees. In open-ended funds, PwC audited 3,413 funds and earned $190.4 million, demonstrating their strength in large, established fund complexes.

Deloitte & Touche shows particular strength in open-ended funds (1,470 funds, $65.1 million in fees) and has grown its closed-end fund presence substantially, earning $11.2 million from 140 funds in 2024.

Ernst & Young has seen mixed results, with declining open-ended fund audit fees (down from $66.8 million to $51.8 million over the five year period) but strong growth in ETF fees (up from $8.3 million to $12.4 million) and closed-end funds (up from $8.8 million to $12.4 million).

KPMG has repositioned itself aggressively, showing dramatic growth in closed-end fund fees over the five-year period (up from $6.6 million to $11.3 million) while maintaining steady presence across other categories.

Cohen & Company, while not a Big Four firm, deserves special mention for its remarkable growth trajectory, particularly in ETFs where it has become the second-largest auditor by fund count (786 funds) behind only PwC.

What's driving the fee increases?

In addition to standard inflationary cost increases, several factors explain why audit fees are rising even as fund counts decline:

Regulatory complexity: The adoption of the Tailored Shareholder Reports framework in October 2022, which became effective in July 2024, required funds to transmit concise annual and semiannual reports while mandating Inline XBRL tagging for shareholder report data. This added layer of structured data requirements increased reporting complexity and audit scope.

Enhanced disclosure requirements: Amendments to Form N-PORT and Form N-CEN reporting requirements, adopted in May 2024, increased the frequency of public Form N-PORT reporting from quarterly to monthly, tripling the amount of portfolio data available to investors annually.

Product complexity: The rise of active ETFs, alternative investment strategies within closed-end funds, and increasingly sophisticated portfolio management techniques all require more intensive audit procedures. Active ETFs accounted for 26% of total ETF net inflows in 2024, reflecting a fundamental shift toward more complex products that require greater audit scrutiny.

Accounting standards updates: Multiple FASB Accounting Standards Updates between 2020 and 2024 addressed equity securities, investment company disclosures, fair value measurement, and derivatives, each adding nuance and complexity to the audit process.

Looking ahead: What this means for Fund Managers

The trends revealed in our analysis have clear implications for fund managers:

- ETF launch costs are rising: With average ETF audit fees climbing above $25,000 and continuing to increase, new ETF launches, particularly for actively managed funds, face higher ongoing costs than five years ago. Managers planning ETF conversions or launches should budget accordingly.

- Consolidation continues: PwC predicts that 20% of current mutual fund firms will be acquired or eliminated by 2030. The economics of traditional fund management are becoming increasingly challenging, making scale more important than ever.

- Audit firm selection matters: The divergent strategies of the major audit firms mean that certain firms have developed particular expertise in specific fund types. Matching your fund structure to an auditor's strengths could yield efficiencies.

Conclusion

The fund industry transformation from traditional mutual funds to ETFs is not just changing where investors put their money and it's fundamentally reshaping the audit landscape. As these funds become more complex, regulatory requirements intensify, and product innovation accelerates, audit fees are rising to reflect the increased scope and sophistication of the work required.

For fund managers navigating this evolving landscape, the key is understanding that audit costs are increasingly tied to product complexity rather than simple asset levels. The future belongs to those who can balance innovation with operational efficiency, choosing fund structures and audit relationships that align with their strategic positioning in this rapidly transforming market.

This analysis is based on Audit Analytics' comprehensive database tracking audit fee disclosures by 1940 Act filers. The database includes over 128,000 fund audit fee records from more than 20,000 distinct funds, covering all registered investment companies with fee disclosures since 2019.

Read our report

For a more comprehensive look at the last five years of fund audit fee trends, see Ideagen Audit Analytics recent report on Fund audit fee trends.

Explore audit and regulatory disclosure data

Expert data you can trust – and find within seconds. Your go-to place for public accounting, governance and disclosure intelligence.

Marie is a CPA and Accounting Research Manager at Ideagen, where she leads the research team and serves as a subject matter expert for Audit Analytics. With thirty years of experience spanning public accounting and corporate finance, Marie began her career at PwC managing audits of SEC registrants and international entities. She later specialized in post-acquisition integration, leading accounting teams, ERP implementations, and financial reporting and analysis. Her diverse leadership experience across accounting, IT, risk management and HR gives her a comprehensive perspective on financial operations and compliance.