Navigating the accounting firm M&A landscape: Essential intelligence for private equity investors

The accounting profession is experiencing significant consolidation, creating both opportunities and challenges for private equity investors eyeing audit firms as potential acquisition targets. Understanding the historical patterns, regulatory complexities, and market dynamics of accounting firm mergers and acquisitions requires access to comprehensive, reliable data, including data that spans decades and captures the nuances of this specialized market.

The Accounting firm M&A opportunity

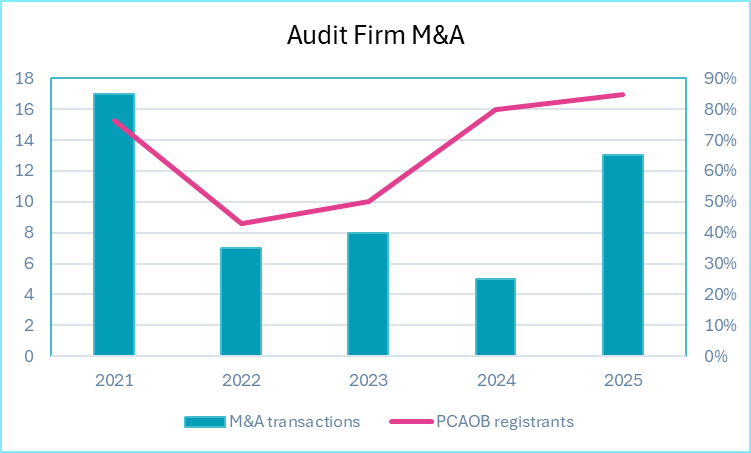

Private equity investment in accounting firms has accelerated notably in recent years. Private equity firms completed multiple significant acquisitions of accounting practices in the past three years, with deal values reaching new highs in the mid-market segment. This trend reflects both the attractive recurring revenue models of audit firms and the fragmentation of the market below the Big Four level. Regardless, the number of deals have not reached the level of 2021, but the character of these deals has changed. As we can see in the following chart, the number of transactions for PCAOB registered audit firms (generally larger and more valuable) has risen to 85% of all transactions, while the total number of transactions rose 62% in 2025 from the prior year

For investors conducting due diligence on potential targets or monitoring competitive dynamics, historical M&A activity provides critical context. Which firms have been serial acquirers? What geographic markets have seen the most consolidation? How do PCAOB registration changes signal shifts in firm capabilities or market positioning?

The data challenge in accounting firm M&A

Unlike public company M&A, accounting firm transactions and organizational changes are not centrally reported in easily accessible databases. Key events that impact firm valuation and client relationships including mergers, splits, name changes, and regulatory status modifications that are scattered across PCAOB filings, press releases, and firm announcements. Piecing together a target firm's history or understanding broader market trends requires extensive manual research.

This information gap creates due diligence risks. Without comprehensive historical data, investors may miss red flags such as frequent partner departures (evidenced by firm splits), loss of PCAOB registration indicating reduced audit capabilities, or a pattern of acquisitions that didn't result in sustained growth.

What our Audit Firm Events Database Tracks

Audit Analytics' Audit Firm Events Database provides systematic tracking of four critical event types affecting U.S. audit firms from January 1998 to present:

• Mergers and Acquisitions: Documents which firms merged or were acquired, preserving both the surviving entity and predecessor firm details

• Name Changes: Tracks rebranding and name modifications that can obscure firm continuity in market research

• PCAOB Registration Changes: Captures both new registrations (indicating expansion into public company audit work) and withdrawals (signaling exit from or loss of SEC audit capabilities)

• Firm Splits: Records when firms divide, often indicating partner disputes or strategic divergence

Key data elements for investment analysis

Our database captures granular details essential for PE due diligence and market analysis:

Firm Identification and Continuity: Each event links predecessor and successor firms through unique identifiers, enabling you to trace a firm's complete organizational history even through multiple name changes and mergers.

Regulatory Status: PCAOB registration numbers, registration dates, and withdrawal dates reveal each firm's ability to audit SEC registrants which is aa key driver of firm valuation and revenue quality.

Geographic Footprint: City, state, and country data for both surviving and predecessor firms enable analysis of geographic consolidation patterns and identification of underserved markets.

Network Affiliations: Tracking of audit firm networks and alliances (like RSM International, BDO Alliance, etc.) helps assess competitive positioning and resource access.

Affiliate Relationships: Foreign affiliate information reveals international capabilities and cross-border service delivery models.

Use cases for private equity investors

Target Identification and Screening: Identify firms that have been active acquirers (potential platform investments) or firms that have remained independent in consolidating markets (potential targets). Filter by geography, PCAOB registration status, and network affiliation to build prospect lists aligned with your investment thesis.

Due Diligence Enhancement: Verify a target firm's representations about its history, uncover undisclosed prior mergers or splits, and assess management stability through historical organizational changes. Cross-reference PCAOB registration dates with claimed audit capabilities.

Market Analysis and Thesis Development: Analyze 25+ years of consolidation patterns to identify underserved geographic markets, understand typical deal structures in the sector, and benchmark your target against historical precedents. Track how many mid-sized firms have successfully scaled through acquisitions versus organic growth.

Portfolio Company Monitoring: For firms in your portfolio, monitor competitive acquisition activity in their markets, track PCAOB registrations by new competitors, and identify potential add-on acquisition targets.

Exit Planning: Understand which types of firms (by size, geography, specialization) have been acquisition targets historically to inform exit strategy and potential buyer identification.

The advantage of historical depth

With data reaching back to 1998, our database captures multiple business cycles and regulatory shifts that have shaped the current accounting firm landscape. This historical perspective is invaluable for understanding:

• How the Sarbanes-Oxley Act (2002) and creation of the PCAOB transformed firm registration patterns

• The impact of the 2008-2009 financial crisis on accounting firm consolidation

• Long-term success rates of merged entities

• Evolution of regional versus national firm strategies

Technical specifications

The Audit Firm Events Database contains comprehensive event-level records with 35 data fields per event, including complete information on both surviving and predecessor firms. Data can be filtered by event date, event type, geographic location, PCAOB registration status, and firm network affiliation. The database integrates seamlessly with our broader suite of audit analytics data products for comprehensive due diligence workflows.

Moving forward

The accounting firm M&A market presents compelling opportunities for private equity investors who can navigate its complexities. Success requires moving beyond anecdotal market knowledge to data-driven analysis of firm histories, consolidation patterns, and regulatory positioning.

Whether you're building an investment thesis, conducting due diligence on a specific target, or monitoring your portfolio's competitive landscape, systematic access to accounting firm organizational history provides the foundation for confident decision-making.

Explore audit and regulatory disclosure data

Expert data you can trust – and find within seconds. Your go-to place for public accounting, governance and disclosure intelligence.

Marie is a CPA and Accounting Research Manager at Ideagen, where she leads the research team and serves as a subject matter expert for Audit Analytics. With thirty years of experience spanning public accounting and corporate finance, Marie began her career at PwC managing audits of SEC registrants and international entities. She later specialized in post-acquisition integration, leading accounting teams, ERP implementations, and financial reporting and analysis. Her diverse leadership experience across accounting, IT, risk management and HR gives her a comprehensive perspective on financial operations and compliance.