London Stock Exchange auditor changes: 2024

Overall, there were 154 different companies listed on the London Stock Exchange (including the AIM sub-market) that experienced an auditor change in 2024. Net gains were led by Johnston Carmichael LLP and Kreston Reeves LLP, both at a net of five.

Top 10 firms

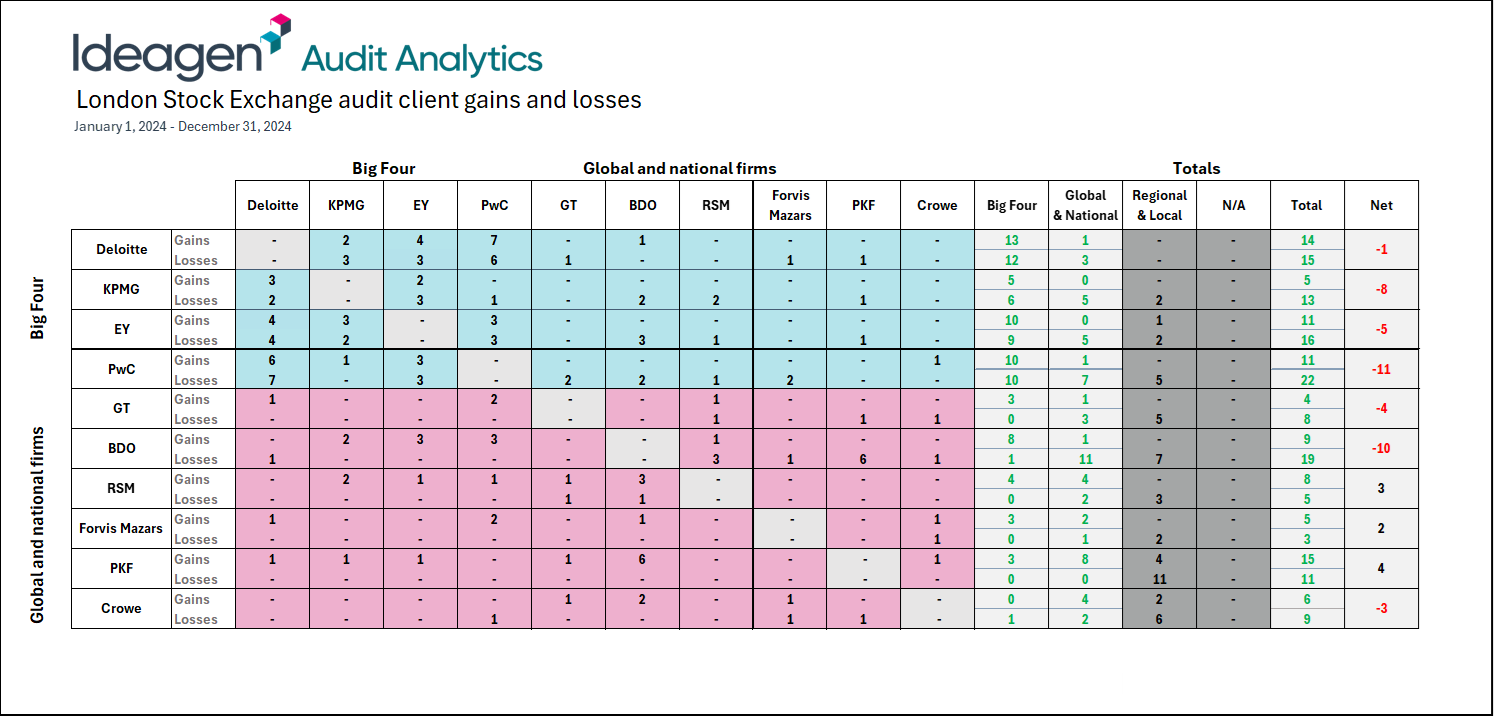

The top 10 auditor networks by LSE client count are the Big Four, Grant Thornton, BDO, RSM, Forvis Mazars, PKF, and Crowe. Overall, there were a total of 88 engagements and 121 departures among these top 10 firms.

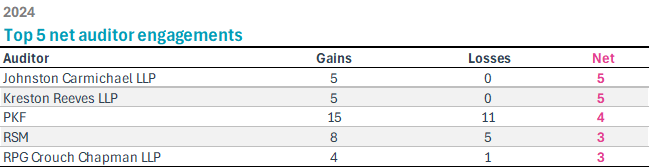

Three firms saw net client gains in 2024 with PKF leading the way with a net gain of 4 clients. RSM had the second most net client gains with three net engagements. Forvis Mazars gained a net of two new clients during the year.

The remaining seven firms each saw a net decrease in their LSE client count. PricewaterhouseCoopers experienced the greatest net loss, losing 11 clients overall in 2024. BDO followed closely with a net loss of 10 clients. KPMG had a net loss of 8 clients, followed by Ernst & Young at 5 clients. Grant Thornton and Crowe each had net losses of 4 and 3 clients respectively.

Net auditor engagements

For the third year in a row, PKF gained the most overall clients listed on the London Stock Exchange (LSE). In 2024, however, PKF gains of 15 new clients were offset by losses of 11, resulting in a net gain of 4 clients during the year. On a net basis, Johnston Carmichael LLP and Kreston Reeves LLP topped the list with a net of five client gains and no losses reported.

The Big Four

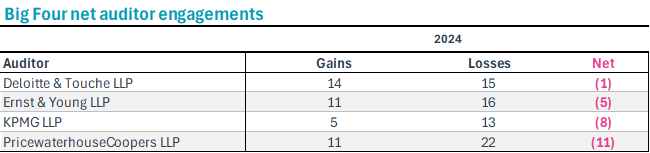

All Big Four firms experienced net losses in LSE clients in 2024. PricewaterhouseCoopers (PwC) saw the largest net loss with 11 clients departing overall. KPMG followed with a net loss of 8 clients, while Ernst & Young (EY) lost 5 clients net. Deloitte had the smallest net loss among the Big Four with just 1 client.

There continues to be heavy competition among these four firms. In 2024, Big Four firms engaged by LSE companies were still most frequently replacing other Big Four firms. However, the Big 4 disclosed 44% of their losses to firms outside of their group.

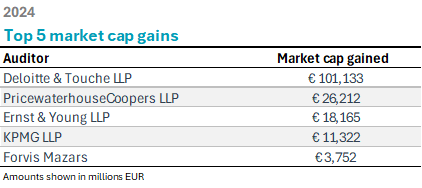

Market cap and audit fee gains

Deloitte & Touche was the leader in LSE client market cap gains in 2024, totaling €101.1 billion.

PricewaterhouseCoopers (PwC) followed with new client market cap gains of €26.2 billion. Ernst & Young gained €18.2 billion in market cap from new clients, with their largest client being Aviva PLC, a British multinational insurance company with a market cap of €13.5 billion. Aviva had previously been audited by PricewaterhouseCoopers.

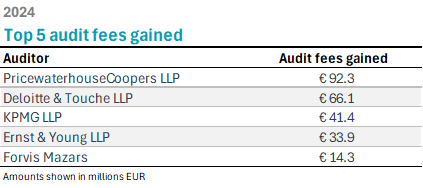

In terms of audit fee gains, PricewaterhouseCoopers ranked number one in 2024, gaining a total of €92.3 million from their new LSE clients. This was largely driven by the client acquisition of WPP, PLC at €53.1 million in audit fees.

Deloitte followed closely with €66.1 million in audit fees incurred from their new LSE clients in 2024. KPMG ranked third with €41.4 million in audit fee gains, while Ernst & Young gained €33.9 million in audit fees from new clients.

Market

The London Stock Exchange has two different markets for trading, the Main Market and the Alternative Investment Market (AIM). The Main Market is a regulated market composed of larger, more established companies. AIM is an unregulated market for small and medium size growth companies.

Across the London Stock Exchange, amidst a net gain of four clients in 2024 (154 wins vs. 150 departures). The Big Four ceded share on net, with none showing in the top five overall or in the individual sub-markets, a pattern that underscores how midtier challengers are capturing momentum amid ongoing client churn.

Explore audit and regulatory disclosure data

Expert data you can trust – and find within seconds. Your go-to place for public accounting, governance and disclosure intelligence.

Marie is a CPA and Accounting Research Manager at Ideagen, where she leads the research team and serves as a subject matter expert for Audit Analytics. With thirty years of experience spanning public accounting and corporate finance, Marie began her career at PwC managing audits of SEC registrants and international entities. She later specialized in post-acquisition integration, leading accounting teams, ERP implementations, and financial reporting and analysis. Her diverse leadership experience across accounting, IT, risk management and HR gives her a comprehensive perspective on financial operations and compliance.