IPO trends Q1 2025

IPO trends Q4 2024

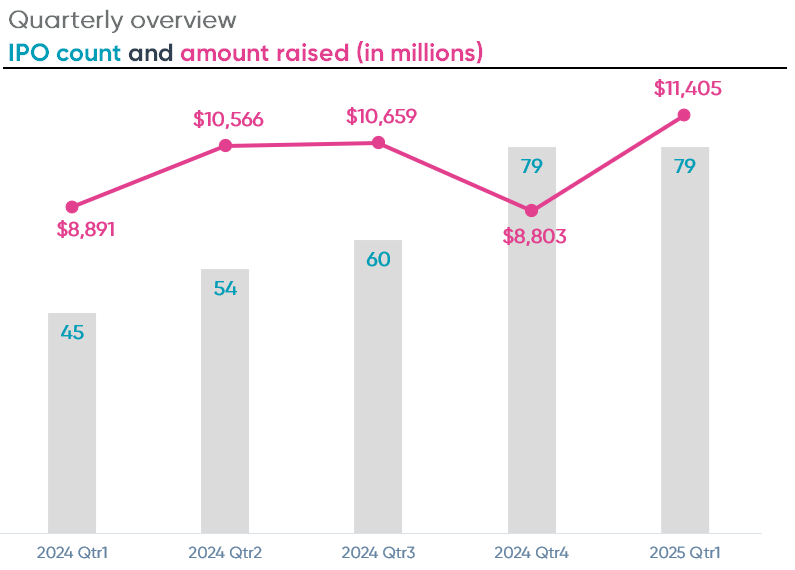

In the first quarter of 2025, there were 79 new initial public offerings (IPOs), which raised $11.4 billion. Total IPOs remained the same as Q4 2024, however, total gross proceeds increased by 30% in Q1 2025 resulting in the largest combined gross proceeds of any quarter throughout the past five quarters and signifying a strong start of the year for IPOs.

Compared to Q1 2024, total IPOs increased by 76%, while total IPO proceeds increased by only 28%. January and February were tied for the most completed IPOs in Q1 2025 at 29 as compared to 21 for March.

IPO type

Traditional IPOs constituted the majority of the public offerings this quarter. There were 58 traditional IPOs, representing about 73% of total public offerings for the quarter, over four percentage points higher than the proportion of traditional IPOs in Q4 2024.

Special Purpose Acquisition Companies (SPACs) represented 24% of total IPOs in Q4 with a total of 19 new offerings. Compared to last quarter, SPAC IPOs decreased by 17% while traditional IPOs increased by just 7%. One of the latest SPAC trends is using these companies to launch cryptocurrency and other digital coin treasury companies.

Traditional IPOs raised an average of $146.3 million per IPO, up significantly from an average of $95.2 million for traditional IPOs in Q4 2024. Traditional IPOs in Q4 2024 were negatively affected by an unusual amount of foreign issuer IPOs for Amercian Depository Shares with an initial offering price of $4.00. SPAC IPOs raised an average of $148 million per IPO in Q1 2025, identical to average SPAC IPO proceeds from the previous quarter. Overall average gross proceeds are down highs in 2024 Q2 and Q3.

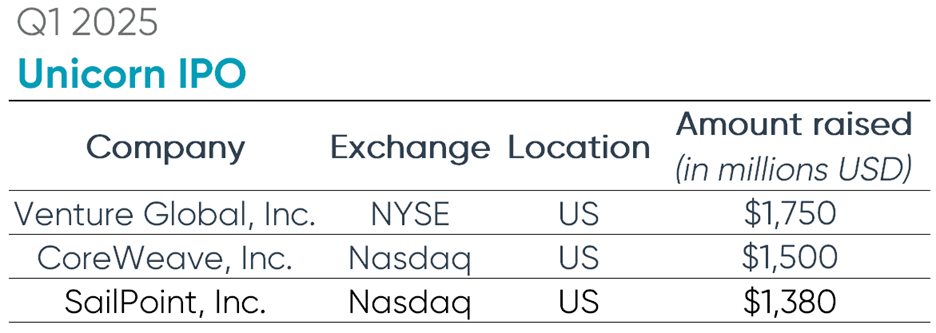

Unicorn IPO

During Q1 2025, there were three companies that raised over $1 billion in proceeds from their initial public offerings. The largest of the three unicorn IPOs this quarter, in terms of proceeds, was Venture Global, Inc.’s public offering. Venture Global, a liquid natural gas exporter, raised $1.75 billion in proceeds from the issuance of 70 million shares at a price of $25 per share. Venture Global conducted its IPO on January 24, 2025, amid increased excitement in the market over relaxed regulations on the oil and gas industry. Since its IPO, Venture Global’s market capitalization has fallen from $60.5 billion on the date of its IPO to around $24 billion as of May 23, 2025. Venture Global currently trades on the NYSE.

The second largest IPO of the quarter was CoreWeave Inc.’s initial public offering, which raised $1.5 billion from the sale of 37.5 million shares at $40 per share. Nvidia backed CoreWeave, which offers AI-integrated cloud services to its customers, underwent the largest IPO for a tech company since 2021. CoreWeave has had impressive success since its IPO, seeing its stock price rise over 160% as of May 23, 2025. CoreWeave’s market performance is seen as a welcome sign for AI companies looking to test the waters. CoreWeave currently trades on the Nasdaq exchange.

The final unicorn IPO of the quarter belonged to Sailpoint, Inc who raised $1.38 billion from the sale of 60 million shares at a price of $23 per share. Sailpoint offers enterprise cybersecurity solutions to its customers. Sailpoint is not a newcomer to the markets and became public again with its IPO on February 13th after being taken private in 2022. Since its recent debut, the stock price has fallen to around $17 per share as of May 23, 2025. Sailpoint, Inc. currently trades on the Nasdaq exchange.

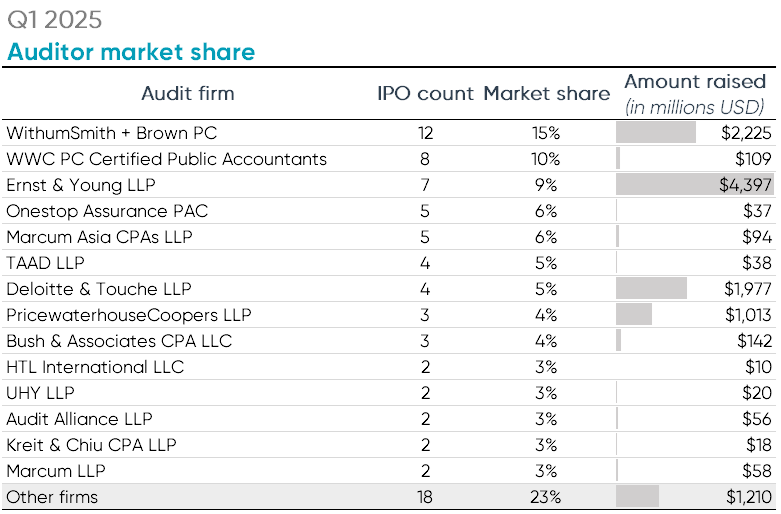

Auditor market share

There were 32 different firms that audited the 79 newly listed companies in Q1 2025. WithumSmith + Brown led all auditors in terms of total IPO client count with 12 new IPO clients after leading in Q4 2024 with 14 clients. Withum individually represented 15% of all Q1 2025 IPOs. WWC PC Certified Public Accountants trailed Withum with eight IPOs audited, while big four member EY audited the most clients with seven IPOs.

This quarter, EY ranked number one in terms of client gross proceeds. EY’s seven clients raised a total of $4.4 billion in gross proceeds and EY was the auditor of recordrd for both Venture Global Inc., the largest IPO of the quarter, and Sailpoint, Inc., the largest IPO of the quarter. Withum followed EY with a total of $2.23 billion in IPO client proceeds, nearly identical to the last quarter’s figure at $2.29 billion and Withum’s Q3 2024 figure as well at $2.27 billion.

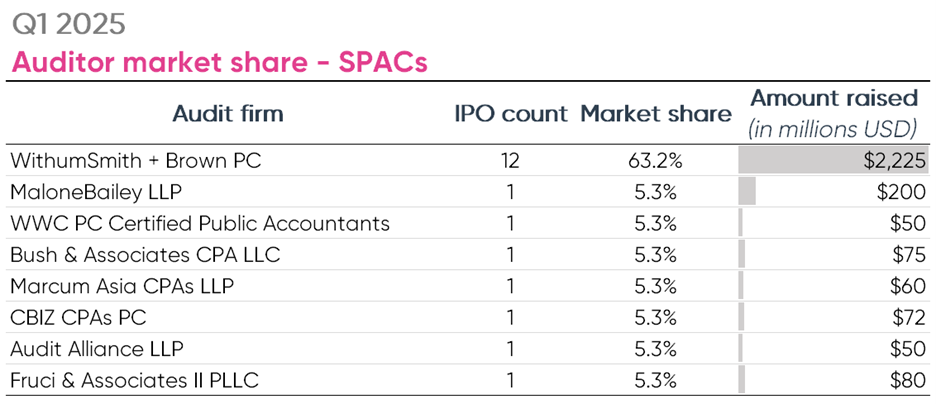

Auditor market share – SPACs

Eight firms audited the 19 SPAC IPOs of Q1 2025. Withum, once again, was the dominant player in the SPAC IPO market, auditing 12 SPAC IPOs this quarter after auditing 13 SPACs in Q4 2024. All Withum’s 12 total IPO clients in Q1 2025 were SPACs and raised a combined total of $2.23 billion in proceeds. Withum accounted for 63% of the SPAC IPO market share this quarter with no other firm auditing more than one SPAC. Marcum, who once competed aggressively with Withum for dominance in the SPAC marketplace, was notably absent from this quarter's rankings.

Direct listings

A less common type of public offering is a direct listing. In a direct listing, investors and employees offer their existing shares to the public and generally do not use underwriters. There were two direct listings in Q1 2025, Cloudastructure, Inc. and NeOnc Technolgies Holdings, Inc., which together raised approximately $110 million in gross proceeds. Bush & Associates was the auditor of record for the Cloudastructure, Inc. IPO while Marcum audited the direct listing for NeOnc.

Explore Ideagen audit intelligence solutions

Find out how Ideagen Audit Analytics can help you achieve your audit goals.

John Means is graduate of Northeastern University where he studied political science and finance. He previously worked for the Boston Consulting Group as a research associate in the tech sector and now works within the Ideagen Audit Analytics solution preparing reports and research on various accounting and financial topics.