Auditor changes in Canada: 2024

Davidson & Company was the leading auditor for total new engagements among Canadian auditor changes in 2024. Davidson engaged 56 new clients throughout the year. Despite engaging the most new clients for 2024, Davidson trailed in net auditor engagements to rival firm MNP who had a total of 29 net engagements.

Global and national firms

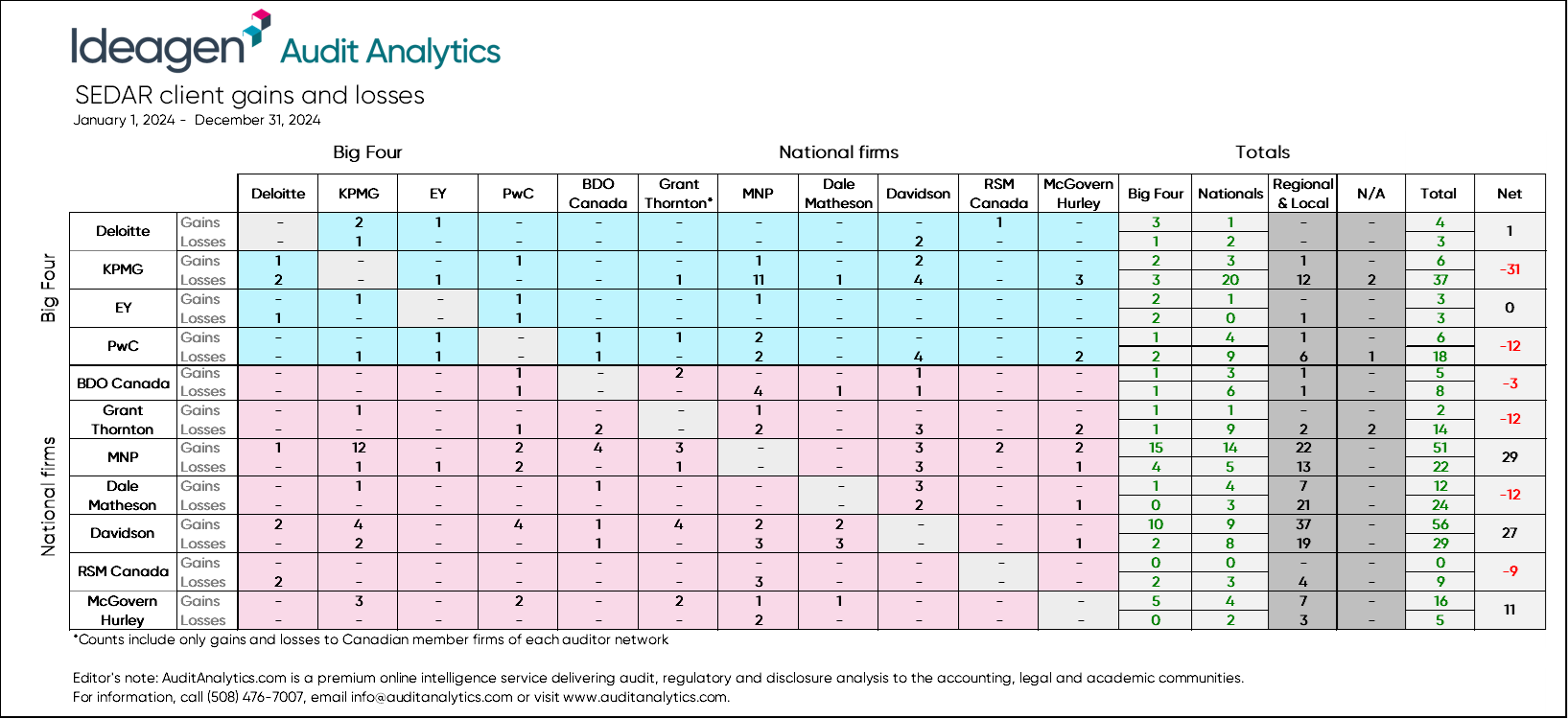

Overall, there were 161 engagements and 172 departures during 2024 among the Big Four and major global and national firms. Five of the top firms had net gains while the other six experienced net losses.

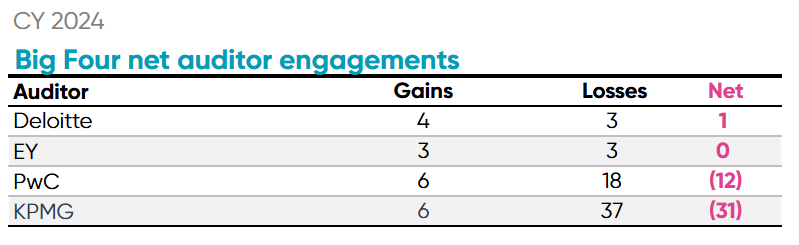

Among the Big Four firms, Deloitte saw the most net client gains in 2024, however it was a down year for most of the Big Four in Canada. In total, Deloitte had four engagements and three departures for a net gain of one client. KPMG and PwC each had six engagements but experienced 37 and 18 departures respectively, leading to net client losses for both firms. EY had three engagements and three departures ending the year even.

Of the remaining global and national firms, there was a mixed bag of net gains and losses. BDO, Grant Thornton, Dale Matheson and RSM Canada all saw net client losses. While MNP, Davidson & Company, and McGovern Hurley all experienced net gains, winning 29, 27 and 12 new clients respectively.

Net auditor engagements

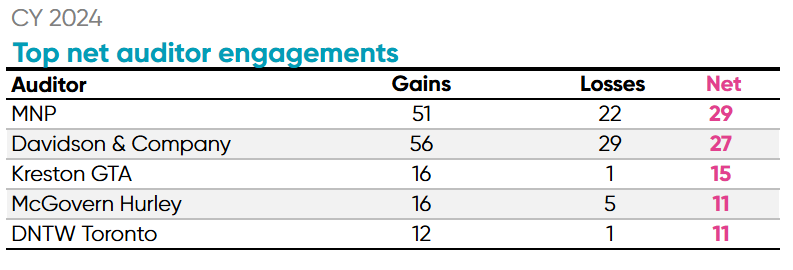

As previously mentioned, MNP had the most net client gains at 29 with 51 engagements and 22 departures. Davidson & Company trailed MNP in net clients gained despite having more engagements. Davidson saw 56 engagements and 29 client losses for a net gain of 27. After a large gap between the top two firms, Kreston GTA, a Toronto-based auditor and affiliate of Kreston Global, placed third in net client gains with 15.

Overall the Big Four underperformed in 2024 in the Canadian market. The firms experienced 19 engagements and 61 departures collectively. KPMG saw the most dramatic loss of clients with 31 net client losses. Although KPMG lost the most clients, the majority of the departures were firms with market capitalization below CAD $100 million. The largest client lost was Cronos Group Inc., a global cannabinoid company based in Toronto, whose market cap was CAD $1.28 billion.

Market cap and audit fee gains

Note: Amounts stated in Canadian dollars

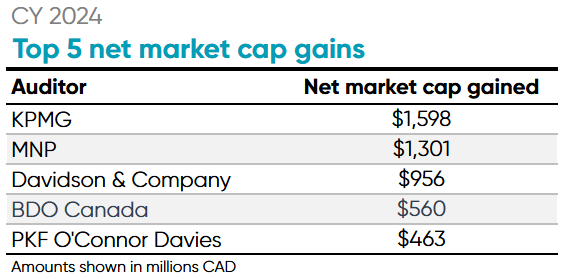

Despite KPMG’s extensive client departures, the firm led in net market cap gained with CAD $1.6 billion. KPMG won the client Russel Metals Inc. from Deloitte whose market cap is CAD $2.69 billion. MNP increased its net market cap represented by $1.3 billion. MNP’s largest client was Firm Capital Mortgage Investment Corporation with a CAD $422 million dollar market cap. MNP tends to focus on smaller and mid-sized Canadian firms meaning that despite leading in net client gains, the net market cap gained was only second in the rankings.

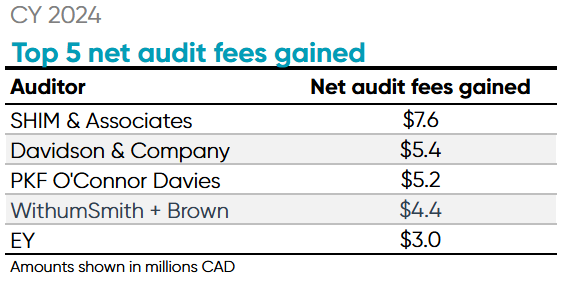

SHIM & Associates, a Vancouver-based auditor, led all firms in net audit fees gained with CAD $7.6 million, two million more than the next firm, Davidson & Company. SHIM & Associates has 45 clients in Canada. Davidson & Company, who placed second in the ranking for net audit fees gained, gained CAD $5.4 million in net fees. Cronos Group, who Davidson won from KPMG, was the largest client gained in terms of fees. Cronos paid CAD $2.67 million in audit fees in 2023.

PKF O’Connor Davies, despite having relatively few engagements, gained CAD $5.2 million in net audit fees. The firm saw the engagements of Oranigram Holdings Inc., The Cannabist Company Holdings and Cansortium Inc. who paid CAD $2.48 million, $1.84 million and $891 thousand respectively for fees in 2023.

Explore internal audit solutions

Get more value, more audits and more flexible workflows from your internal audit software.

John Means is graduate of Northeastern University where he studied political science and finance. He previously worked for the Boston Consulting Group as a research associate in the tech sector and now works within the Ideagen Audit Analytics solution preparing reports and research on various accounting and financial topics.