Auditor changes roundup: Q1 2025

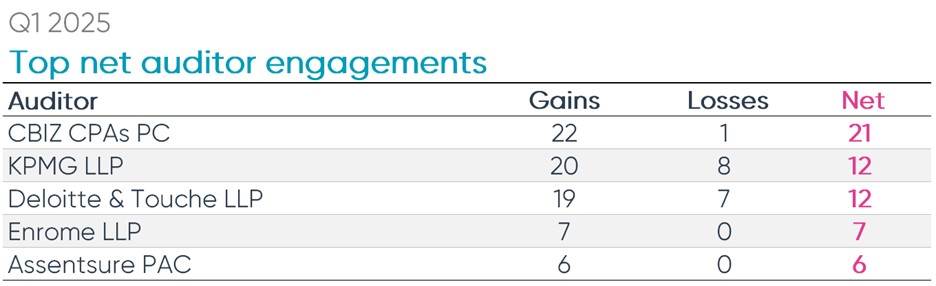

CBIZ CPAs gained the most Securities and Exchange Commission (SEC) audit clients in the first quarter of 2025 with 21 new clients on net. Nineteen of these new engagements were prior clients of Marcum’s attest business which was acquired by CBIZ CPAs in November of 2024. The cash-and-stock transaction between CBIZ CPAs and Marcum was valued at $2.3 billion overall.

Trailing the tally of new clients received by CBIZ CPAs were Big Four members KPMG and Deloitte who saw 20 and 19 engagements respectively and both tied for a net gain of 12 new clients. KPMG gained 13 new clients from other Big Four firms while Deloitte gained 12 clients from those same firms. For both firms, the most significant gains came from EY.

Global and national firms

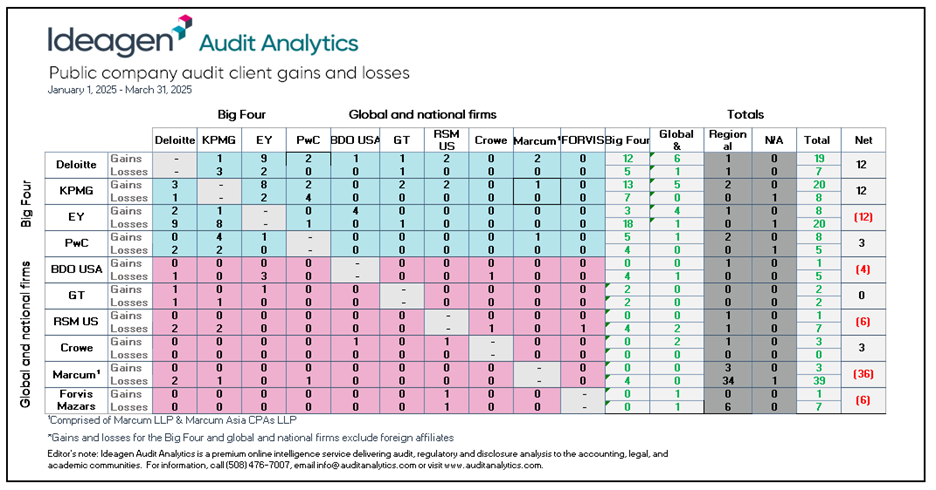

Overall, the top ten global and national audit firms gained 66 and lost 100 clients during Q1 2025.

The table below presents a complete view of the gains and losses of the major global and national firms. It shows the number of SEC audit clients that each auditor gained or lost. Additionally, it shows which firm the client was won from or lost to.

The majority of the Big Four had positive quarters with Deloitte, KPMG and PwC all gaining clients on net. KPMG had an impressive 20 new engagements but also lost 8 clients, amounting to a net gain of 12 clients. There was a notable increase in auditor switching among the top firms from Q4 2024 where BDO led in client gains with four net clients gained and where there were only 22 new engagements among the top ten global and national firms.

Marcum, for the second quarter in a row, had the most net audit client losses in Q1 with 39 departures and three new engagements for a net loss of 36 clients. These losses come on the heels of 27 additional losses in Q4 2024. As mentioned earlier, the vast majority of Marcum’s losses this quarter were a result of the merger with CBIZ CPAs, who engaged many of these lost clients.

EY had 12 net losses this quarter. Of EY’s 20 departures, 18 former clients engaged other Big Four firms. EY’s largest client departures included Dexcom Inc. and Stifel Financial Corp.

Market cap and audit fee gains

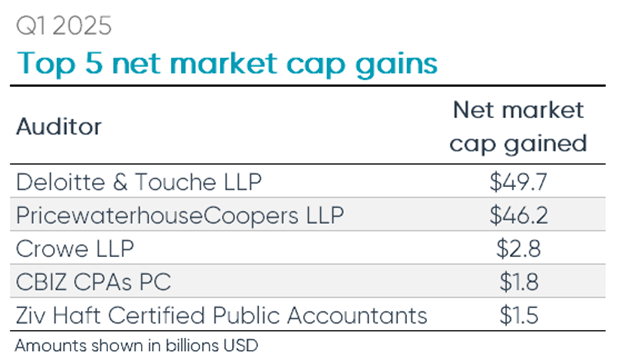

Deloitte had the largest net market cap gains from their Q1 2025 audit clients at $49.7 billion. Their largest client by far was Dexcom Inc., which boasts a market cap of over $30 billion. The company is an international medical device manufacturer and was previously audited by Ernst & Young.

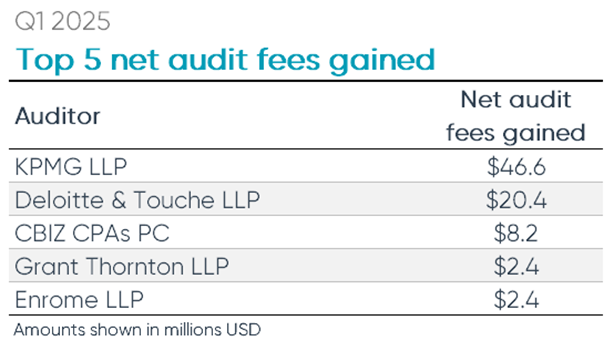

In terms of net audit fee gains, KPMG, was the leader with a net of $46.6 million from their Q1 2025 clients. Their largest client gained in terms of audit fees was QuidelOrtho Corp., which paid $10.9 million in audit fees for fiscal year 2024.

Explore audit and regulatory disclosure data

Expert data you can trust – and find within seconds. Your go-to place for public accounting, governance and disclosure intelligence.

John Means is graduate of Northeastern University where he studied political science and finance. He previously worked for the Boston Consulting Group as a research associate in the tech sector and now works within the Ideagen Audit Analytics solution preparing reports and research on various accounting and financial topics.