The mystery of the missing going concern critical audit matters

Critical audit matters and going concern opinions

The definition of a critical audit matter is “any matter arising from the audit of the financial statements that was communicated or required to be communicated to the audit committee and that: (1) relates to accounts or disclosures that are material to the financial statements and (2) involved especially challenging, subjective, or complex auditor judgment”.1 A going concern opinion is issued when there is substantial doubt about an entity’s ability to meet its obligations and continue its business for a reasonable period of time. This would seem to lead to a going concern issue classification as a critical audit matter, whether the explanatory paragraph is included by the auditor or not. That did not hold true in our review of the going concern opinion data consolidated with our critical audit matters data.

PCAOB Guidance

While the Public Company Accounting Oversight Board (PCAOB) provides a principle-based standard for CAMs, it does not specify which matters should always be considered CAMs. However, as far as it relates to going concern, the PCAOB staff had previously explicitly stated how they would expect the interplay between the two to work out, in guidance from 2019:

“There could be situations in which a matter meets the definition of a CAM and also requires an explanatory paragraph, such as going concern.

For these situations, both the explanatory paragraph and the required communication regarding the CAM would be provided, by either: Including the required communications for a CAM in the explanatory paragraph, with a cross-reference in the CAM section to the explanatory paragraph, or Including both the explanatory paragraph and the CAM communication separately in the auditor’s report, with a cross-reference between the two sections.”

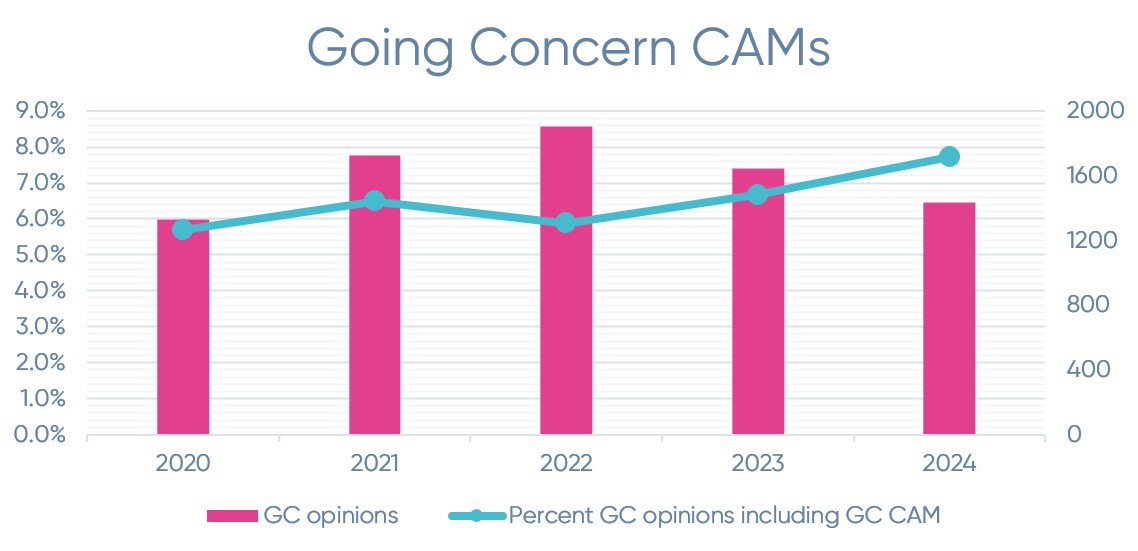

Going Concern CAMs

In our most recent report on CAM’s we found in FY2024, only 37% of all going concern opinions contained at least one critical audit matter. This compares to 68% of our general population’s rate of opinions with CAMs. The rate of going concern opinions with CAMs had increased by two percentage points each year through FY2023, followed by a decline of a percentage point in FY2024.

For the five-year period from 2020-2024, there were 8,044 opinions that included a going concern emphasis of a matter paragraph, of which only 6.5% of going concern opinions included a CAM related to the going concern.

We have 161 going concern CAMs in FY2024 but not all of them were related to a going concern opinion. Fifty of the going concern CAMs were not concurrent with a going concern opinion, leaving 111 CAMs at a rate of 7.7% for going concern opinions with a related going concern CAM in FY2024.

There are a few possible reasons for this that come readily to mind. First, there could be a CAM for the business driver that was leading to the going concern, as we see debt leading in the cited taxonomy relating to the going concern opinions for those with CAMs. Second, the explanatory paragraph may be seen as providing the information needed, thus resulting in duplication if there is also a CAM. Third, maybe the matter was not considered to meet the technical definition of ”…arising from the audit…” as arguably most management and boards could be expected to have recognized that they do not have enough cash to fund operations for a year before the audit commenced.

Presumably, to have a going concern explanatory paragraph without the related going concern CAM, the issue did not meet the criteria of a CAM for the auditors in some manner, unfortunately for our mystery, the data cannot answer that question at this time.

Explore audit and regulatory disclosure data

Expert data you can trust – and find within seconds. Your go-to place for public accounting, governance and disclosure intelligence.

Marie is a CPA and Accounting Research Manager at Ideagen, where she leads the research team and serves as a subject matter expert for Audit Analytics. With thirty years of experience spanning public accounting and corporate finance, Marie began her career at PwC managing audits of SEC registrants and international entities. She later specialized in post-acquisition integration, leading accounting teams, ERP implementations, and financial reporting and analysis. Her diverse leadership experience across accounting, IT, risk management and HR gives her a comprehensive perspective on financial operations and compliance.