SEDAR and Canadian exchanges going concern opinions

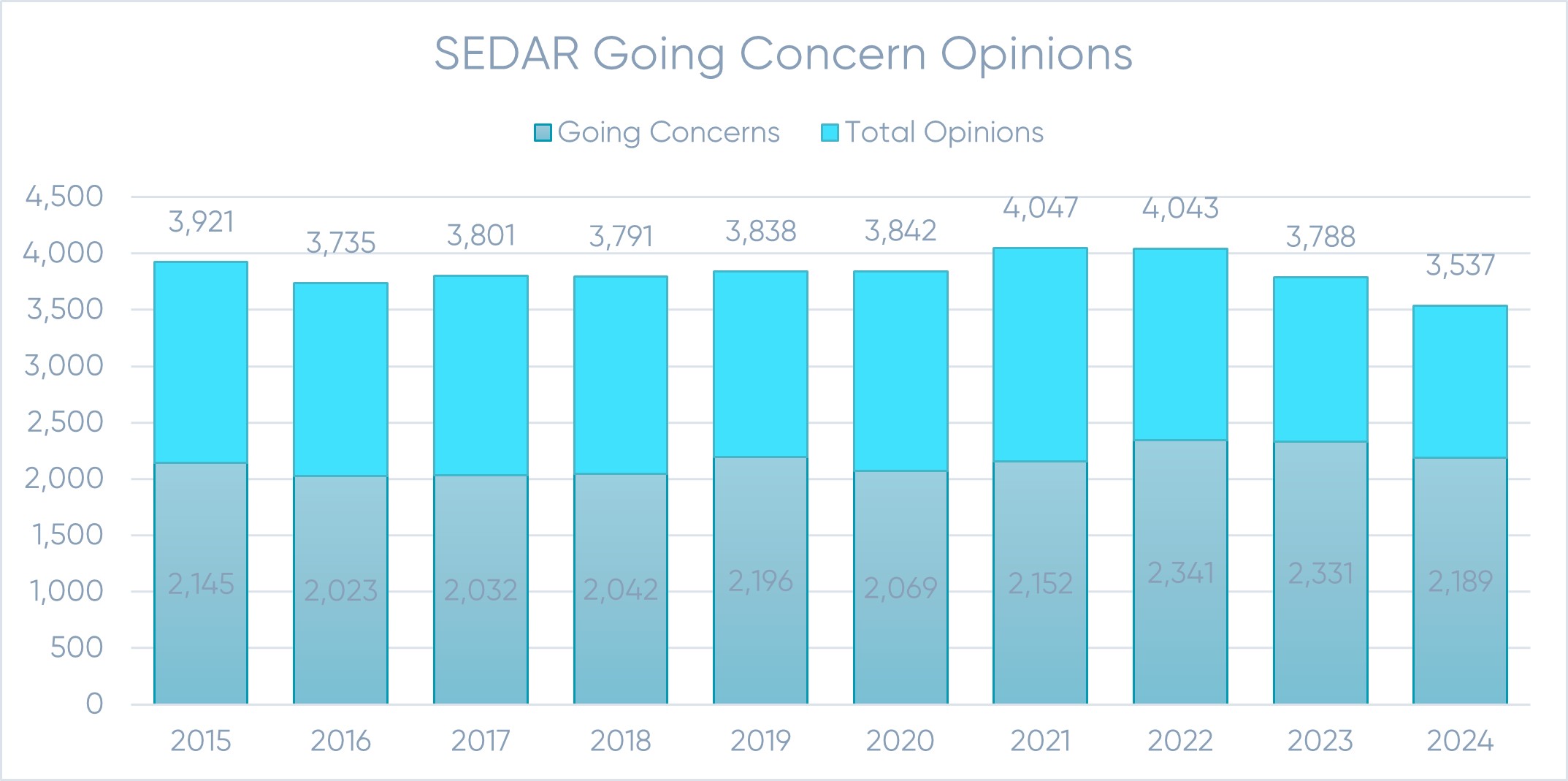

The number of SEDAR registered companies that received a going concern decreased by 6% during FY2024 to 2,189 companies. Total opinions also declined by 6% in FY2024.

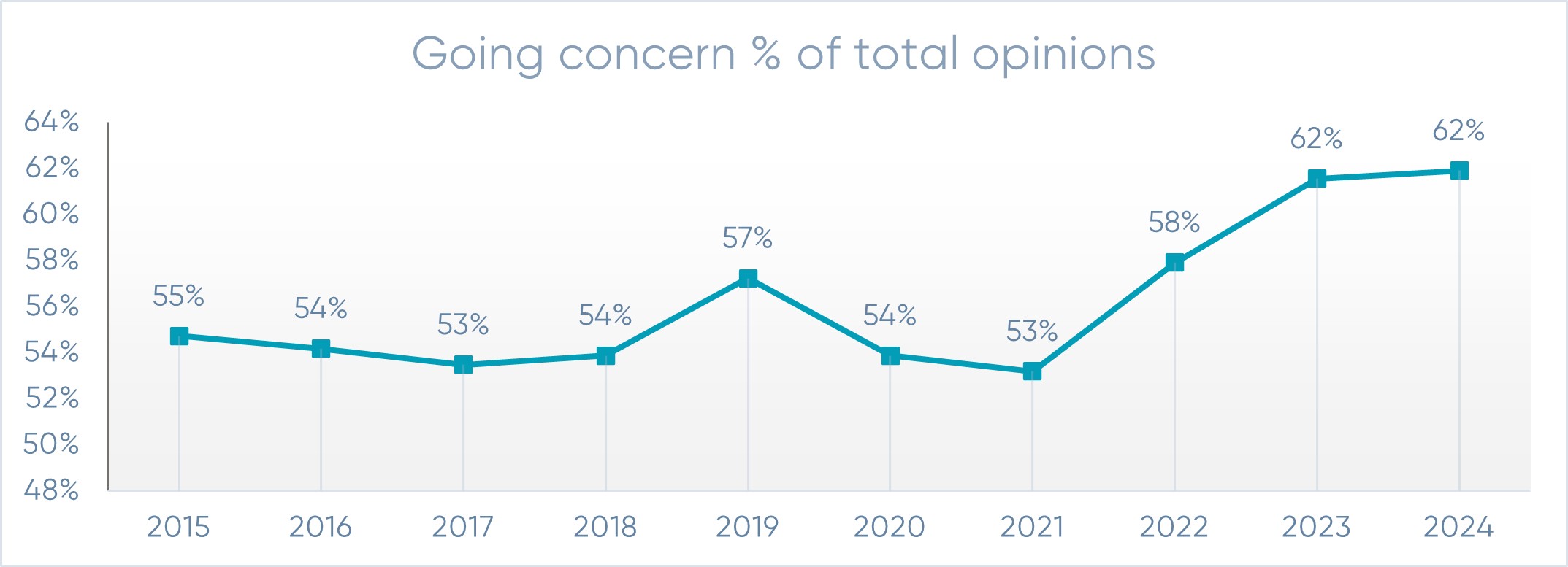

The going concern rate has surpassed 50% since FY2013 and has steadily increased since FY2021. In FY2024 and FY2023, SEDAR companies had a going concern rate of 62%.

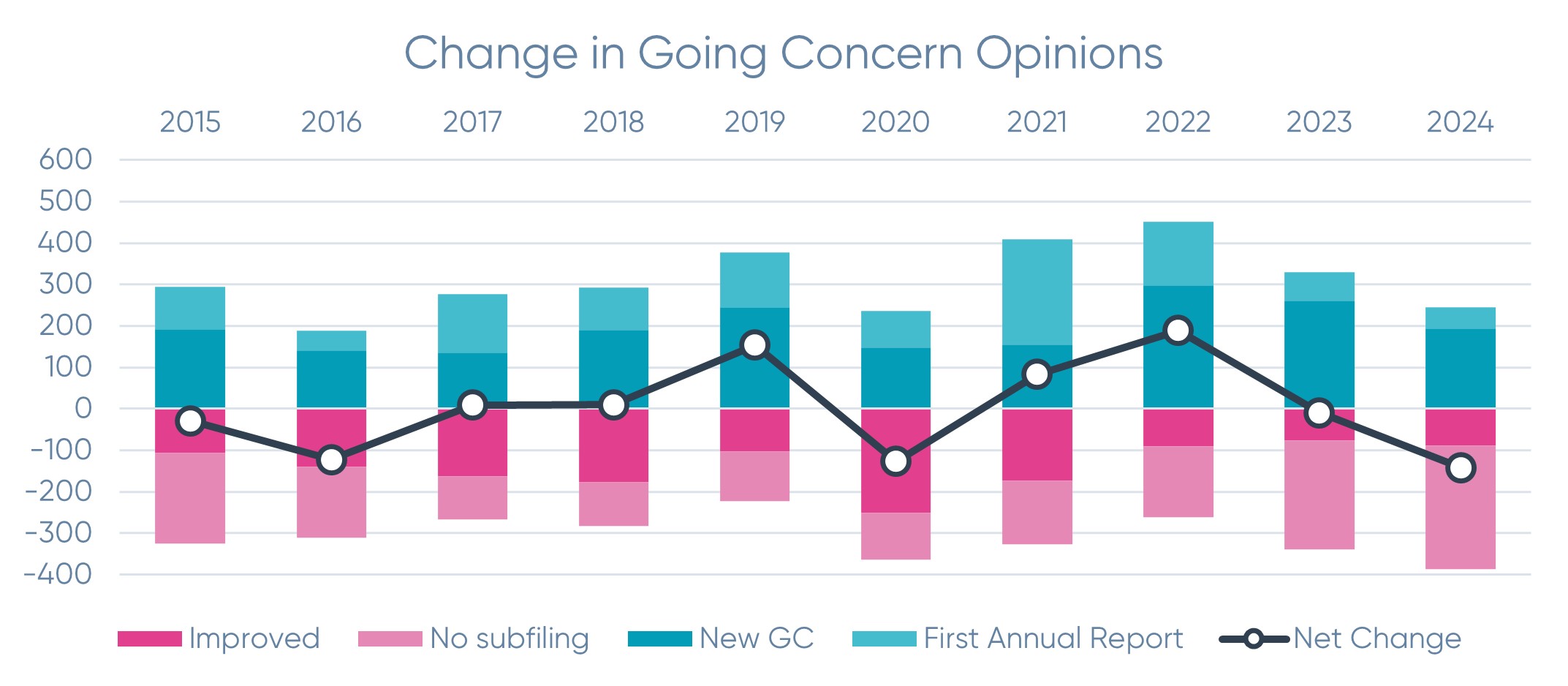

Changes in going concern opinions

SEDAR going concern opinions experienced a net decrease of 142 in FY2024. Contributing to this net change was an addition of 193 new and 52 first going concern opinions and an attrition of 387 going concern opinions between FY2024 and FY2023. Unfortunately, 298 or 8% of the going concern opinions were due to no subsequent filings and just 89 or 1% were due to receiving a clean opinion from improved financial outlooks.

In FY2024, 79% of going concern increases came from existing companies with a new going concern. Along with FY2023, also at 79%, this is the highest rate in the past ten years. The vast majority of total going concern opinions are repeat going concerns, currently at 81% of all going concern opinions.

Canadian exchanges going concern opinions

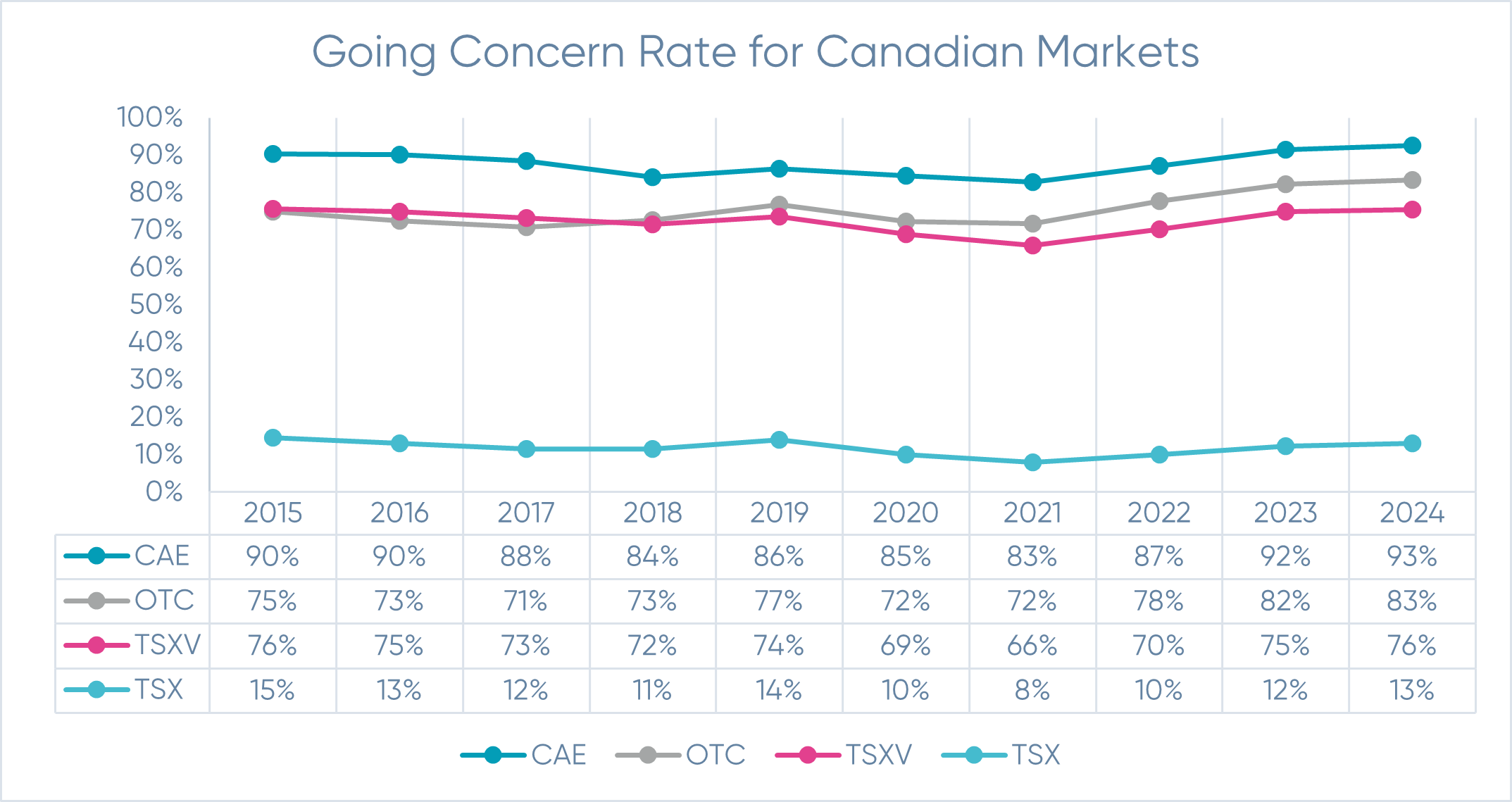

The numbers are far higher when we strip out the companies that have a registration but for which the Canadian exchanges are not their primary exchange. The chart below shows the going concern rates of the subset of companies that have an active primary listing on the main exchanges: Toronto Stock Exchange (TSX), TSX Venture (TSXV) and the Canadian Securities Exchange (CSE) as well as the OTC markets (OTC):

From the above chart we can see the starkest difference, with the Toronto Stock Exchange with the most diverse and developed companies having low rates of going concern opinions (13% at FY2024). However, their rates have been increasing along with the other exchanges. TSX has the lowest percentage of mining companies at 20% of listings, followed by the OTC at 29%, then CSE and TSXV at 44%. The CSE also has a significant level of emerging sector companies including cannabis and crypto, contributing to their higher rates. TSX Venture Exchange hosts early-stage companies and notably has a shell company program. These companies, by their nature, often have a limited operating history, negative operating cash flow, and the resulting reliance on financing.

Given how closely these exchanges trend lines track, macro factors such as changes in interest rates, particularly given their impact on capital intensive industries, are impacting all the exchanges at a similar rate.

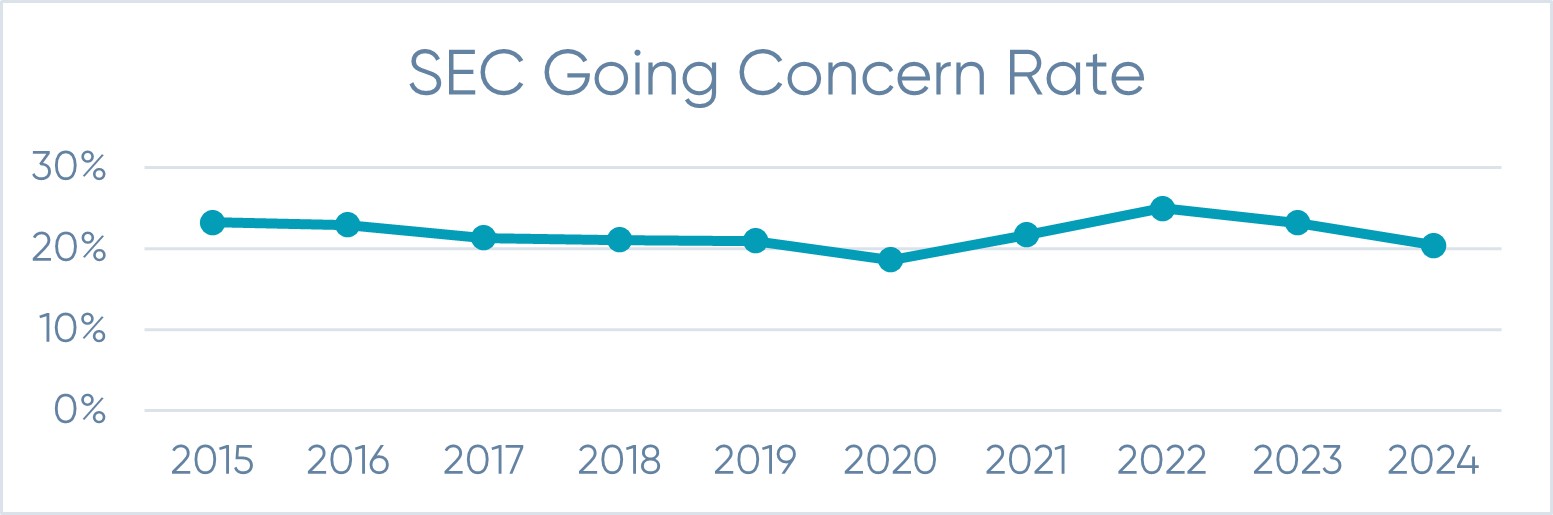

The comparable rate for SEC opinions in our latest report on Going Concerns (INSERT LINK HERE) for FY2024 was 20% and the trend was as follows:

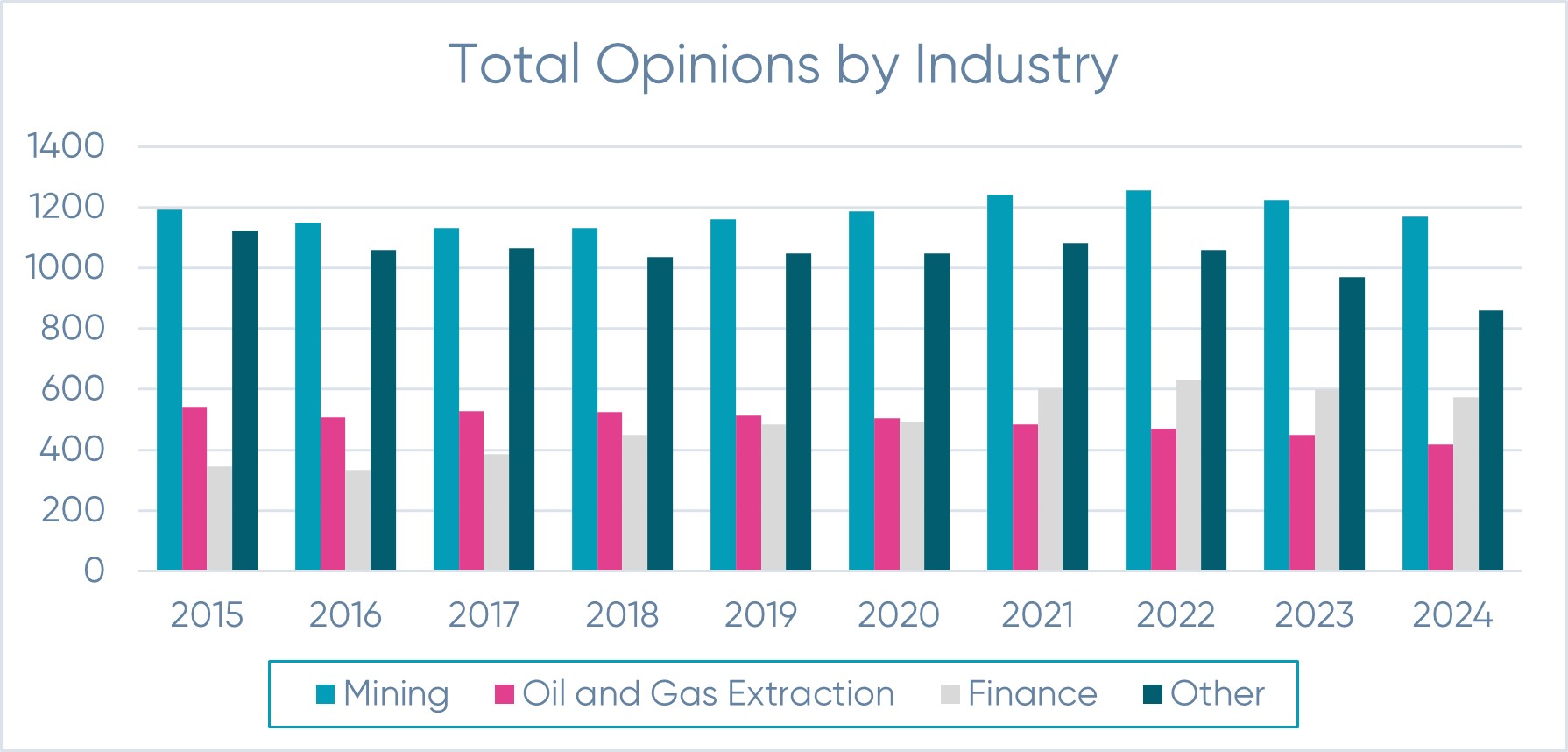

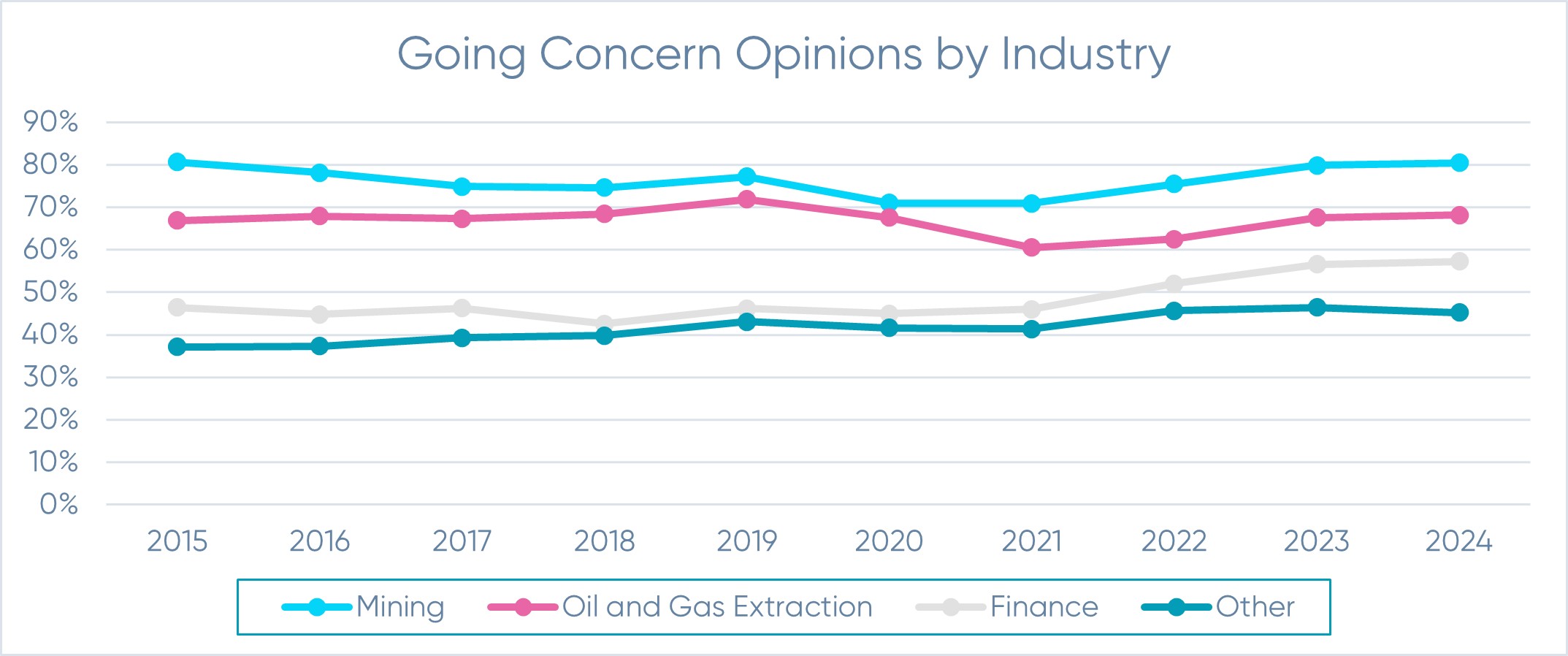

The mix of companies in Canada is quite different between exchanges and overall is quite different from what we see in our SEC analysis. The top three industries on the Canadian exchanges for Going Concern opinions make up 71% of all FY2024 opinions:

The associated going concern rates are below. The high level of going concern on the Canadian stock exchanges is primarily linked to their resource-based economy, with a significant proportion of companies in the mining and oil and gas industries These extractive industries require substantial upfront investment and long lead times to revenue and positive operating cash flows. Even for established companies with proven reserves and production, the volatile nature of commodity prices can increase liquidity risks.

Explore audit and regulatory disclosure data

Expert data you can trust – and find within seconds. Your go-to place for public accounting, governance and disclosure intelligence.

Marie is a CPA and Accounting Research Manager at Ideagen, where she leads the research team and serves as a subject matter expert for Audit Analytics. With thirty years of experience spanning public accounting and corporate finance, Marie began her career at PwC managing audits of SEC registrants and international entities. She later specialized in post-acquisition integration, leading accounting teams, ERP implementations, and financial reporting and analysis. Her diverse leadership experience across accounting, IT, risk management and HR gives her a comprehensive perspective on financial operations and compliance.