IPO trends Q2 2025

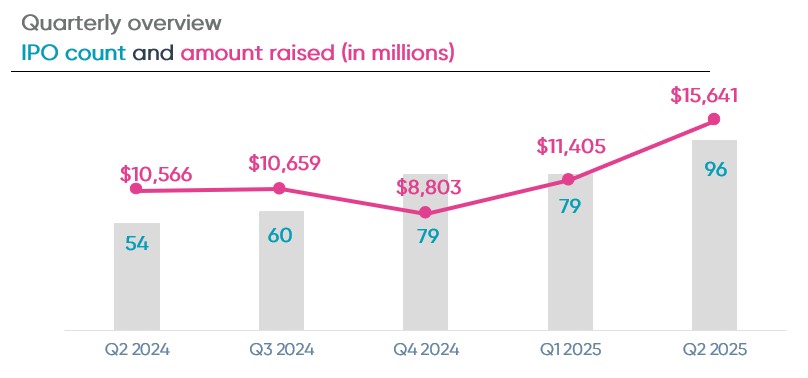

In the second quarter of 2025, there were 96 new initial public offerings (IPOs), which raised $15.6 billion. Total IPOs increased by 22% from the first quarter and total gross proceeds increased by 37% over Q1 2025.

Compared to Q2 2024, total IPOs increased by 78% from 54, while total IPO proceeds increased by 48% from $10.6 million.

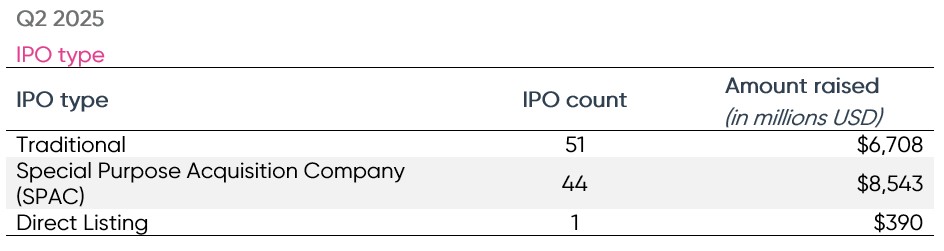

IPO type

Traditional IPOs constituted the majority of initial public offerings this quarter. There were 51 traditional IPOs, representing about 53% of total public offerings for the quarter, over twenty percentage points lower than the proportion of traditional IPOs in Q1 2025.

Special Purpose Acquisition Companies (SPACs) represented 46% of total IPOs in Q2 with a total of 44 new offerings. Compared to last quarter, SPAC IPOs increased by 131% while traditional IPOs decreased by 12%. One of the latest SPAC trends is using these companies to launch cryptocurrency and other digital coin treasury companies.

Traditional IPOs raised an average of $131.5 million per IPO, down from an average of $146.3 million for traditional IPOs in Q1 2025. Traditional IPOs in Q2 2025 were negatively affected by the 23 foreign issuer IPOs for American Depository Shares with an initial offering price of $4.00. There were 33 foreign issuer traditional IPO’s in total for the quarter. SPAC IPOs raised an average of $194 million per IPO in Q2 2025, 31% higher than average SPAC IPO proceeds from the previous quarter.

Unicorn IPO

During Q2 2025, there was one company that raised over $1 billion in proceeds from their initial public offerings. Circle Internet Group’s public offering, a peer-to-peer payments technology company that now manages the stablecoin USDC, raised $1.05 billion in proceeds from the issuance of 34 million shares at an IPO price of $31 per share. During Q1 2025, there were three with proceeds ranging from $1.4 billion to $1.8 billion. Since its IPO on June 5, 2025, Circle Internet Group’s market capitalization has increased from $18.52B to $37.16B, an increase of over 100%.

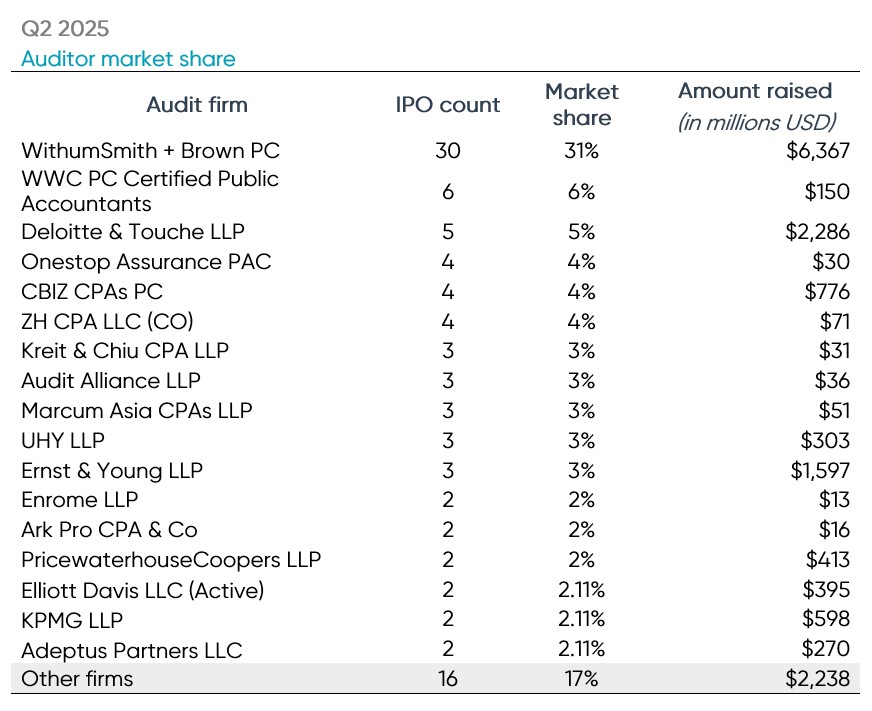

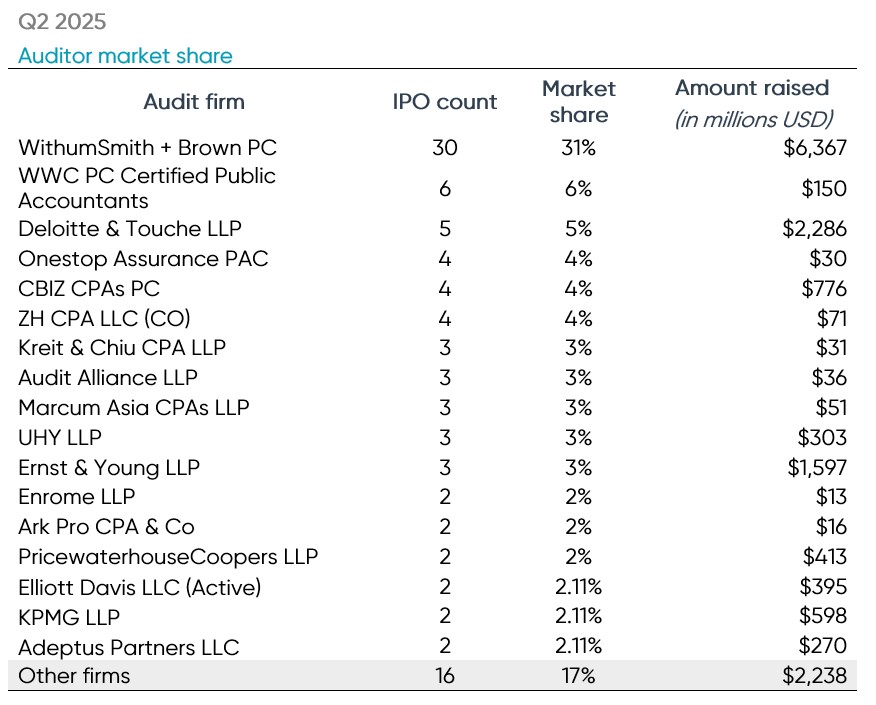

Auditor market share

There were 33 different firms that audited the newly listed companies in Q2 2025. WithumSmith + Brown again led all auditors in terms of total IPO client count with 30 new IPO clients. Withum individually represented 31% of all Q2 2025 IPOs. WWC PC Certified Public Accountants trailed Withum with six IPOs audited, while big four member Deloitte audited the most clients with five IPOs.

This quarter, Withum also ranked number one in terms of client gross proceeds of $6.4 billion. Deloitte’s clients raised a total of $2.3 billion in gross proceeds and they were the auditor of record for Circle, the largest IPO of the quarter.

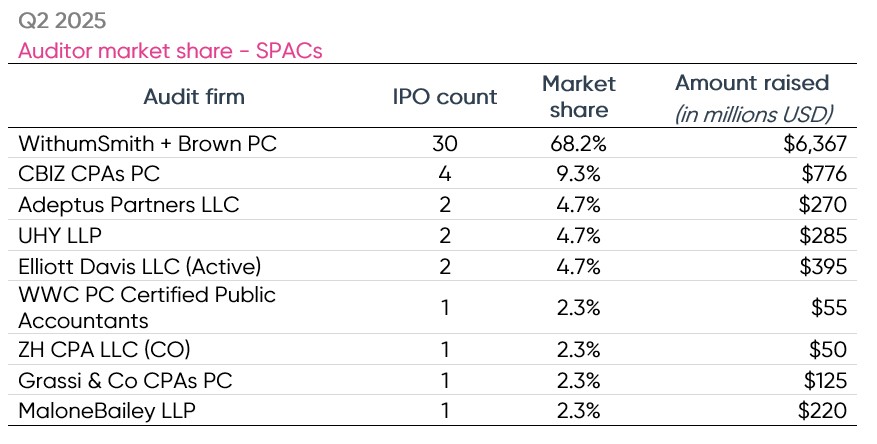

Auditor market share – SPACs

Twenty-seven different firms audited the 52 SPAC IPOs of Q2 2025. Withum, once again, was the dominant player in the SPAC IPO market, auditing 30 SPAC IPOs this quarter Withum’s SPACs and raised a combined total of $6.4 billion in proceeds. Withum accounted for 68% of the SPAC IPO market share this quarter. Second was CBIZ, who acquired the former leader, Marcum, and audited 4 SPAC IPO’s.

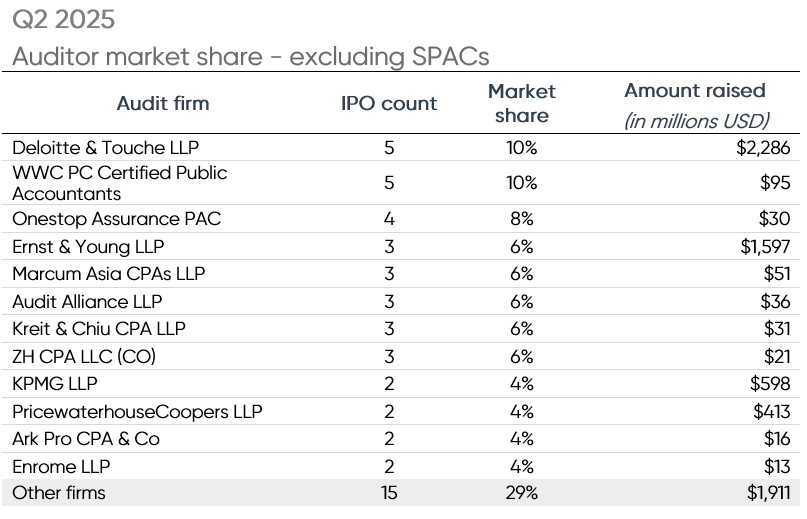

Excluding SPACs

Deloitte led the audits of non-SPAC IPOs at 5 IPOs for 10% of the market. WWC followed with 10% of the market share, also at 5 IPOs.

Direct listings

A less common type of public offering is a direct listing. In a direct listing, investors and employees offer their existing shares to the public and generally do not use underwriters. There was one direct listing in Q2 2025, Arrive AI Inc. which raised approximately $390 million in gross proceeds. Assurance Dimensions was the auditor of record for the IPO.

Explore audit and regulatory disclosure data

Expert data you can trust – and find within seconds. Your go-to place for public accounting, governance and disclosure intelligence.

Marie is a CPA and Accounting Research Manager at Ideagen, where she leads the research team and serves as a subject matter expert for Audit Analytics. With thirty years of experience spanning public accounting and corporate finance, Marie began her career at PwC managing audits of SEC registrants and international entities. She later specialized in post-acquisition integration, leading accounting teams, ERP implementations, and financial reporting and analysis. Her diverse leadership experience across accounting, IT, risk management and HR gives her a comprehensive perspective on financial operations and compliance.