Internal control failures: A growing web of risk factors

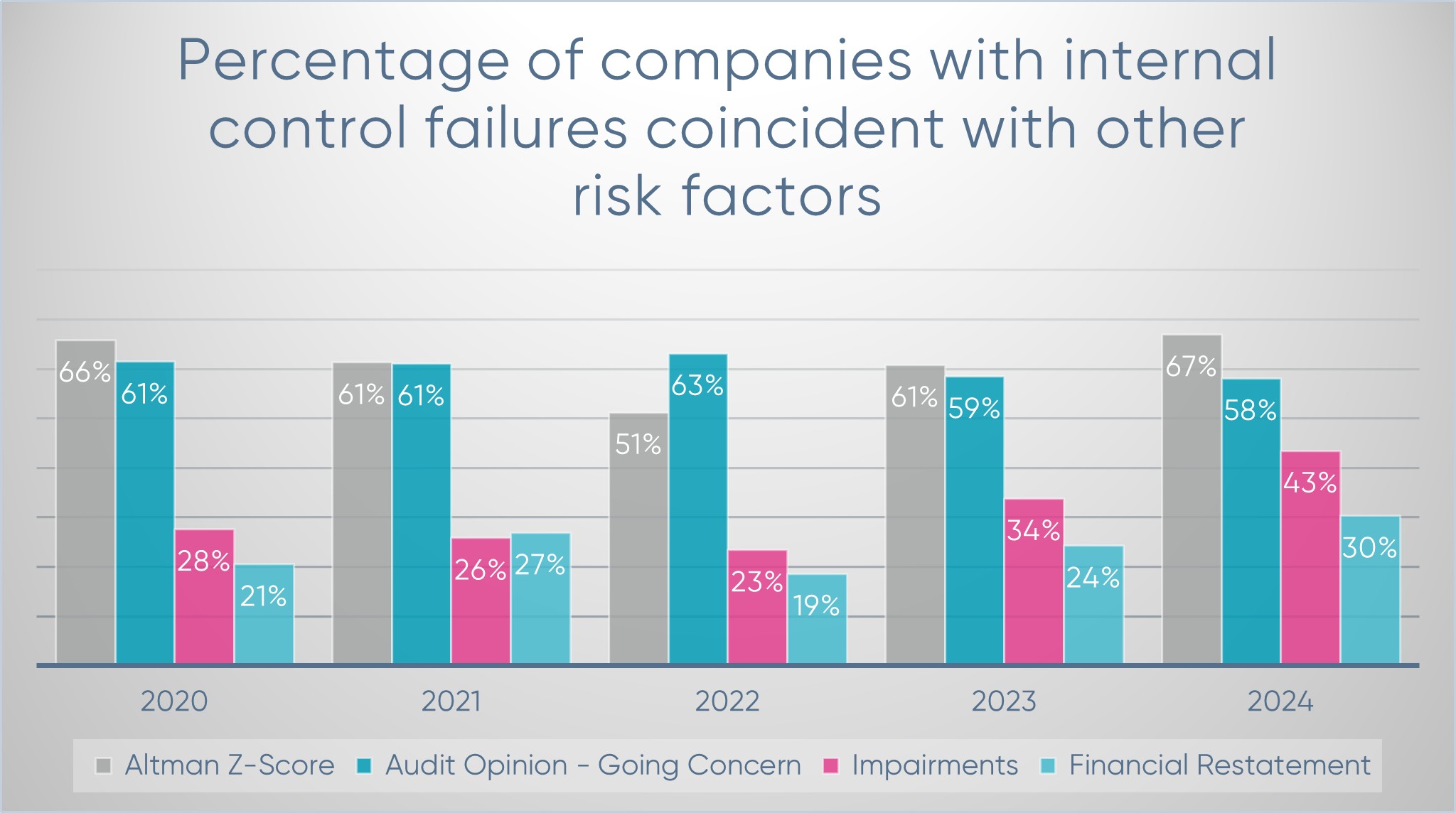

In today’s complex financial landscape, internal control failures rarely occur in isolation. A recent five-year analysis (2020–2024) reveals a compelling pattern: companies experiencing internal control breakdowns often face a host of other financial and operational risks.

This population is limited to those companies that reported a material weakness in internal controls for the years 2020-2024. NOTE: The corresponding risk factor years are based upon flag year, defined as the year the risk factor was disclosed.

Key risk factors coinciding with internal control failures

The chart tracks the percentage of companies with internal control failures that also exhibit one or more of the following risk indicators:

- Audit Opinion – Going Concern

- Financial Restatements

- Impairments

- Altman Z-Score (a measure of financial distress)

What the data shows:

Altman Z-Score surges in 2024

After a gradual decline from 66% in 2020 to 51% in 2022, the percentage of companies with poor Altman Z-Scores jumped to 67% in 2024. This spike may reflect worsening financial health among companies with control issues.

Going Concern opinions remain high

Across all five years, 58–61% of companies with internal control failures also received a going concern opinion from auditors. This suggests a persistent link between control issues and doubts about a company’s ability to continue operating for one year.

Impairments are on the Rise

After declining to 23% in 2022, impairments increased to 43% in 2024, indicating that more companies are writing down assets—possibly due to overvaluation or deteriorating business conditions.

Financial restatements becoming more common

Restatements rose from 21% in 2020 to 30% in 2024, pointing to growing concerns about the accuracy of financial reporting in companies with internal control deficiencies.

Conclusion: A convergence of risks

This data underscores a critical insight: internal control failures are often symptomatic of deeper financial and operational problems. Whether it's going concern issues, asset impairments, or financial restatements, these risk factors tend to cluster—making internal control health a key signal of a higher likelihood of broader instability.

What should stakeholders do?

- Auditors should scrutinize control environments more closely when other risk factors are present.

- Investors should view internal control failures as red flags for deeper financial trouble.

- Management must prioritize remediation efforts and transparency to rebuild trust and stability.

This data is derived from our Audit Risk Quality database that tracks risk factors but also the severity of the risk factors and allows the user to identify in one company profile the spectrum of risk factors.

SOX 404 Disclosures

For more insights on internal controls, read our latest report including twenty years of trends and developments in internal controls

Explore audit and regulatory disclosure data

Expert data you can trust – and find within seconds. Your go-to place for public accounting, governance and disclosure intelligence.

Marie is a CPA and Accounting Research Manager at Ideagen, where she leads the research team and serves as a subject matter expert for Audit Analytics. With thirty years of experience spanning public accounting and corporate finance, Marie began her career at PwC managing audits of SEC registrants and international entities. She later specialized in post-acquisition integration, leading accounting teams, ERP implementations, and financial reporting and analysis. Her diverse leadership experience across accounting, IT, risk management and HR gives her a comprehensive perspective on financial operations and compliance.