Annual Report (Form 10-K) Restatements

This further analysis of a subset of data from our 2025 Financial Restatements Report focuses on the

restatements of the comprehensive annual report that publicly traded companies file with the Securities and

Exchange Commission (SEC). The 10-K is subject to an annual audit by independent external auditors,

providing a higher level of assurance on the accuracy of the financial information. Consequently, a restatement

of an audited 10-K often signals a more serious breakdown in internal controls or accounting practices,

attracting greater scrutiny from regulators like the SEC. While 10-Q restatements can also be important, 10-K

restatements typically indicate more substantial issues that could affect long-term valuation and investor

confidence

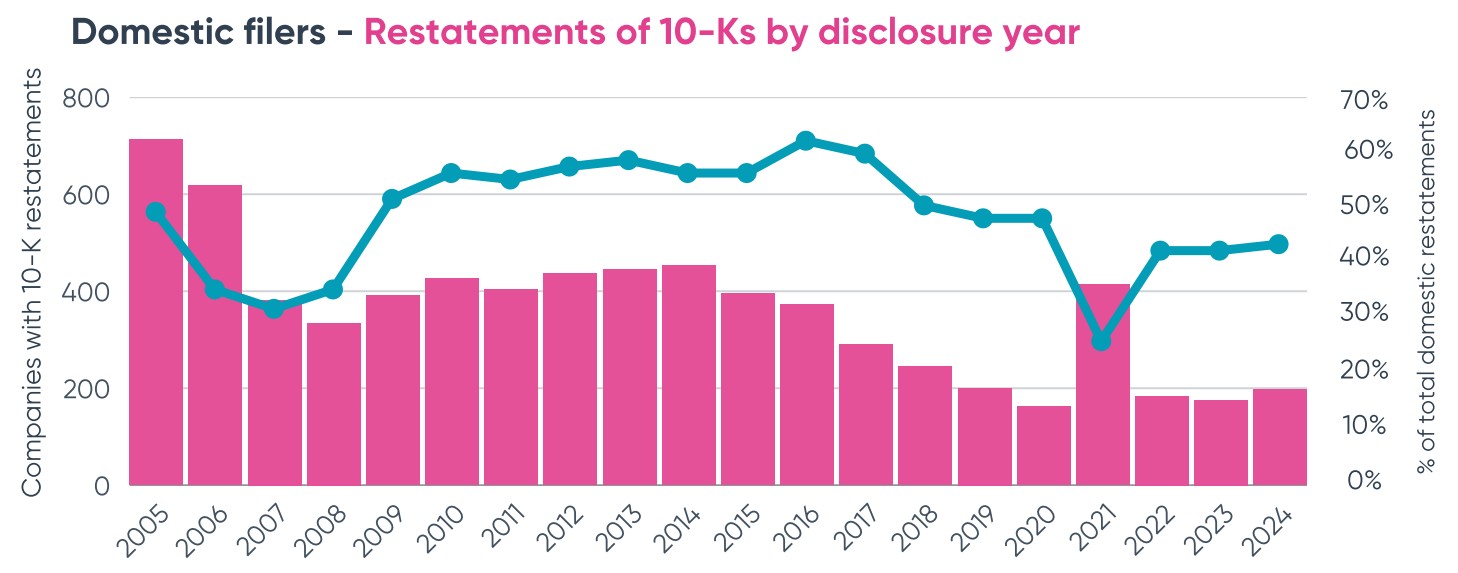

This metric, representing the percentage of all domestic restatements that are specifically annual (10-K) reports, provides a unique lens into the evolving nature of financial reporting accuracy. The graph reveals that in 2005, approximately 49% of domestic restatements were annual 10-K reports. This proportion saw a dip in the subsequent years, falling to around 34% by 2007, before steadily climbing to consistently hover above 50% for nearly a decade, peaking around 60% in 2016. A notable shift occurred in 2021, where the percentage sharply declined to 29%, only to stabilize in the low 40 percentile in the years that followed. The percentage was impacted in 2021 by Special Purpose Acquisition Companies (SPACs) that restated, which included multiple restatements of the same periods, including quarters. While overall numbers have declined dramatically, this also reflects the impact of declining SEC registrants overall.

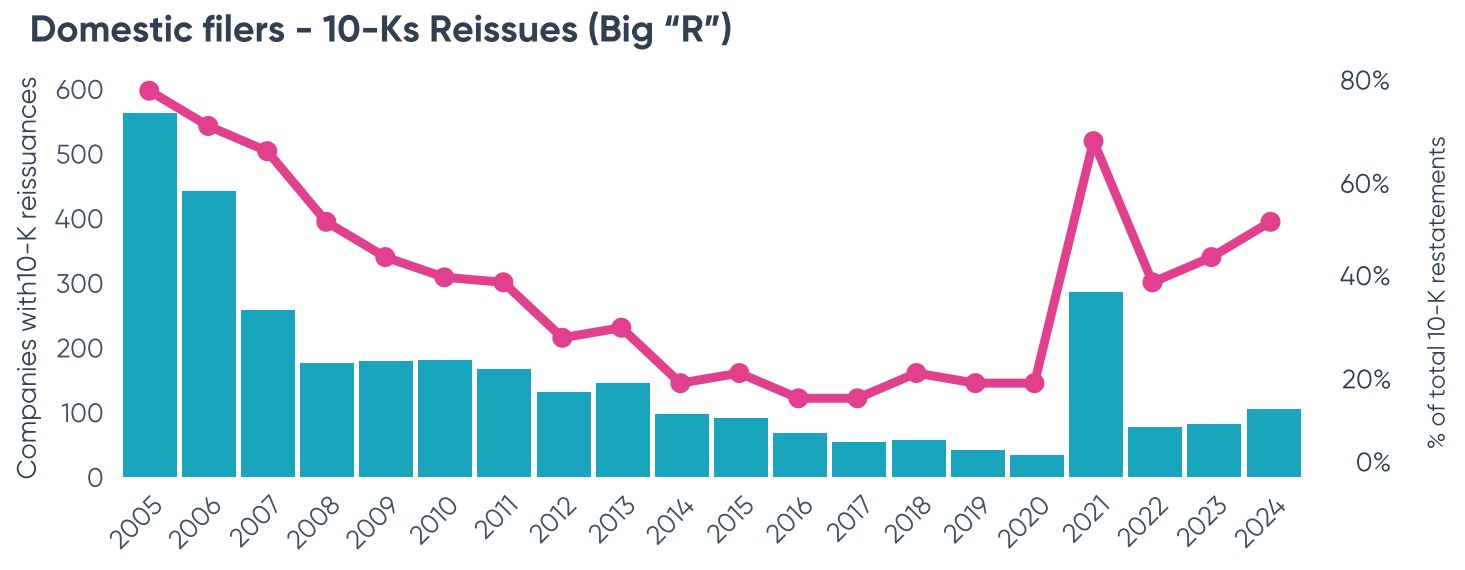

Distinguishing between "Annual reissues- Big “R” restatements (material corrections requiring reissuance of financial statements) and "Annual revisions" (corrections disclosed when prior periods are presented in current period statements). In the initial period of 2005-2006, total 10-K restatements were high, with annual reissues being the dominant type, particularly in 2005, indicating a significant number of material errors being corrected. Following this, from 2007 through 2020, there was a general decline in the overall number of 10-K restatements. During this extended period, annual revisions consistently outnumbered annual reissues, often by a substantial margin, suggesting a shift towards less severe, immaterial corrections. However, 2021 marked a dramatic reversal, with a sharp surge in total 10-K restatements, primarily driven by a significant increase in annual reissues for debt and equity accounting misstatements due to specific regulatory guidance which heavily impacted SPACs.

Post-2021, the total number of 10-K restatements declined to be closer to historical levels, however still elevated. In the past four years, when combined, Marcum and BF Borgers have collectively been the auditor of record during the restated period on over two hundred 10-K restatements. Reissuance as a percent of restatement is currently occurring at a rate of 72% for their restatements. The new normal includes more SPACs and SPAC restatements resulted in reissuance of a 10-K at twice the rate of other domestic companies in 2022 and 2023 and ten percentage points higher in 2024.

The same issues top the rankings for 10-K restatements and reissues. Not only is Debt/Equity the leading issue in the past four years but the data for 10-K restatements from 2005-2024 shows that it has become the most frequent cause overall, accounting for nearly half of all occurrences over the period. This rise is directly linked to the 2021 surge in SPAC restatements, driven by new SEC guidance on accounting for warrants and redeemable shares. The dynamic nature of financial innovation and the challenges of applying existing accounting standards to new structures are clearly reflected in this shift. Despite this, the same issues in the top four for the 20-year period are also present in the past four years, albeit in different order

Explore Ideagen audit intelligence solutions

Need audit intelligence? We’ve done the research for you.

Marie is a CPA and Accounting Research Manager at Ideagen, where she leads the research team and serves as a subject matter expert for Audit Analytics. With thirty years of experience spanning public accounting and corporate finance, Marie began her career at PwC managing audits of SEC registrants and international entities. She later specialized in post-acquisition integration, leading accounting teams, ERP implementations, and financial reporting and analysis. Her diverse leadership experience across accounting, IT, risk management and HR gives her a comprehensive perspective on financial operations and compliance.